PORTLAND, Ore. — Spot truckload freight volume increased 1.2% during the week ending August 11, with the availability of spot reefer and flatbed freight making up for a decline in van loads, said DAT Solutions, which operates the industry’s largest network of load boards.

Nationally, the number of available trucks increased 3.7% compared to the previous week. Average spot rates in August remain below July averages.

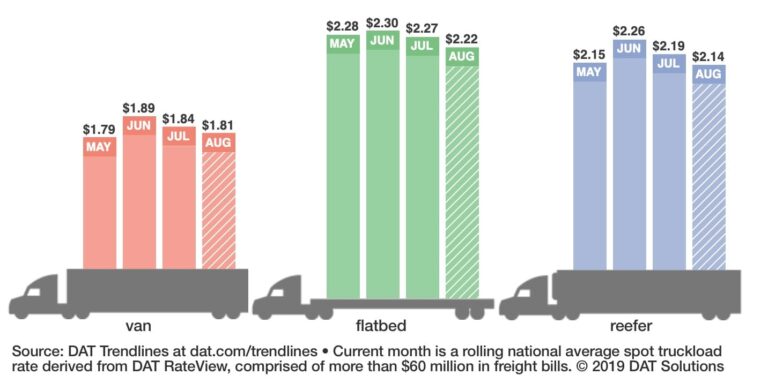

National average spot rates through Sunday, August 11, include:

- Van: $1.81 per mile, 3 cents lower than the July average

- Flatbed: $2.28 per mile, 5 cents lower than July

- Reefer: $2.14 per mile, 5 cents lower than July

Van trends

Van volume slipped 3% last week, and 57 of DAT’s top 100 van lanes by volume had lower rates. Among the few positive markets was Buffalo, where van freight volume increased 3% compared to the previous week and the average outbound rate rose 7 cents to $2.08 per mile. Otherwise, spot van volumes have been sliding over the past four weeks, especially in large Southeastern freight hubs:

- Atlanta, down 8% over four weeks

- Charlotte, North Carolina down 5%

- Memphis, Tennessee, down 7%

- Houston, down 5%

The national average van load-to-truck ratio dropped from 2.2 to 2.1. That’s nearly a full point lower than the August 2018 average.

Reefer trends

Demand for reefer trucks trailed off in California and Texas last week, and the majority of high-traffic reefer lanes paid lower last week. There were early signs of activity shifting northward, as significantly higher volumes from Denver (up 34%) and Grand Rapids, Michigan, (up 71%) helped elevate the national average reefer load-to-truck ratio from 4.2 to 4.3.

While apple harvests won’t kick in strongly until the end of August, demand for trucks sent rates higher on key Midwestern lanes:

- Grand Rapids, Michigan, to Cleveland surged 62 cents to $3.71 per mile

- Grand Rapids, Michigam, to Atlanta added 31 cents to $2.59 per mile

- Chicago to Atlanta rose 20 cents to $2.77 per mile

- Chicago to Philadelphia was up 16 cents to $3.03 per mile

- Chicago to Denver increased 13 cents to $2.40 per mile

Key takeaways

- Fewer reefer loads out of California meant truckload capacity was more available elsewhere. Reefer load volume out of Los Angeles fell 10% last week, Sacramento, California, was down 5%, and Ontario declined 3%.

- The national average spot van rate is 20% lower year over year, when the average rate was $2.31 per mile.

- There’s still uncertainty over how shippers will react to shifting tariff deadlines on Chinese imports. So far in August, spot van volumes indicate a lack of urgency to move goods ahead of the Sept. 1 deadline for additional taxes to take effect.

DAT Trendlines is a weekly snapshot of month-to-date national average rates from DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $65 billion in annualized freight payments. DAT load boards average 1.2 million load searches per business day.

For the latest spot market loads and rate information, visit dat.com/trendlines and follow @LoadBoards on Twitter.

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.