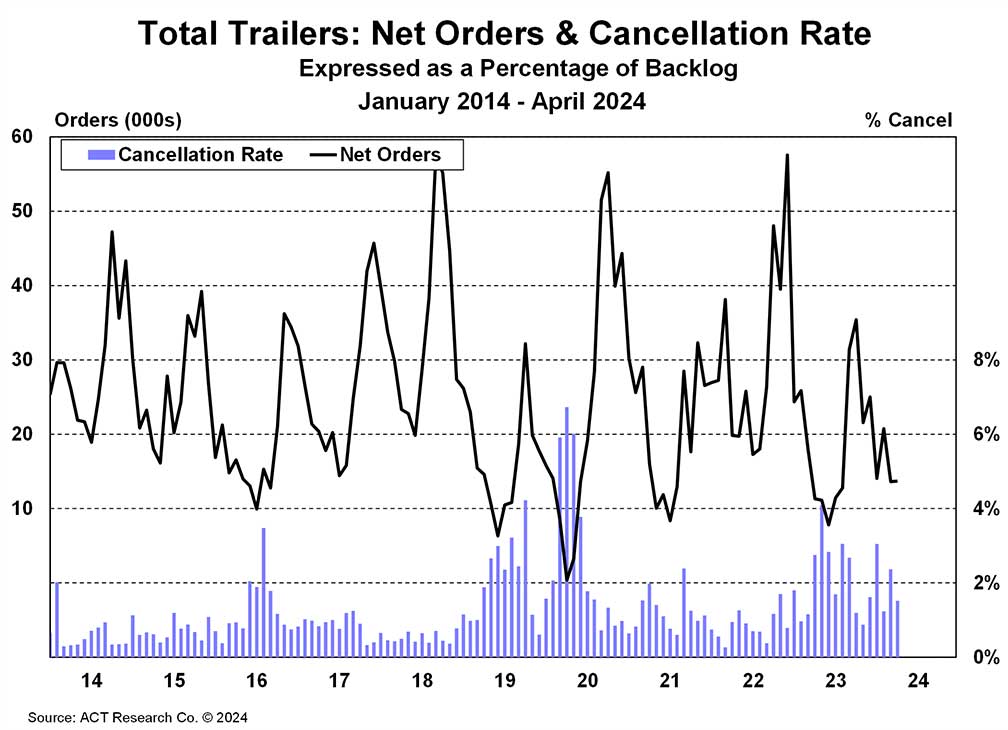

COLUMBUS, Ind. — Research shows that April trailer net orders were more than 21% higher, but stood a mere 100 units above March’s intake. This brings the first trimester net order activity to 62,100 units, 22% lower than the first four months of 2023, with its faster paced order environment, pent-up demand, and moderately congested supply chain, according to this month’s issue of ACT Research’s State of the Industry: U.S. Trailers report.

“Seasonally adjusted, April’s orders were 17,300 units compared to a 13,800 seasonally adjusted rate in March,” said Jennifer McNealy, director of commercial vehicle market research and publications at ACT. “On that basis, orders increased 25% month over month. Dry vans grew 41%, with reefers up 26%, but flats were 27% lower compared to April 2023.”

Cancellations dropped to 1.5% of the backlog, down from 2.3% in March, she said, adding that seven of 10 markets remained above the 1% mark, with OEMs indicating cancellations from multiple fleets and dealers.

“In this capex-constrained environment, and with an expensive EPA mandate landing in 2027, fleet willingness to spend on trailers is under considerable pressure,” McNealy said. “Couple these factors with overstocked dealer inventories proving hard to move, a short-and-soft peak order season, and the absence of a need for carriers to boost trailer-to-tractor ratios, and it adds up to a challenging part of the cycle for the U.S. trailer industry.”

Bruce Guthrie is an award-winning journalist who has lived in three states including Arkansas, Missouri and Georgia. During his nearly 20-year career, Bruce has served as managing editor and sports editor for numerous publications. He and his wife, Dana, who is also a journalist, are based in Carrollton, Georgia.