PORTLAND, Ore. — Demand for capacity lifted spot truckload freight volumes and rates to monthly highs in the last week of August, said DAT Solutions, which operates the industry’s largest network of load boards. The number of posted van, refrigerated, and flatbed loads from August 26 to Sept. 1 increased 7% compared to the previous week while available capacity dipped 2.4% heading into Labor Day weekend.

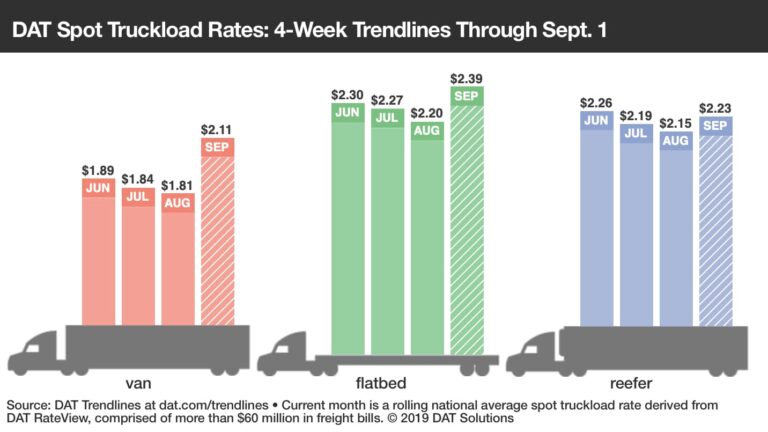

National average spot rates, August 2019, include:

- Van: $1.81 per mile, 3 cents lower than the July average

- Flatbed: $2.20 per mile, 7 cents lower than July

- Reefer: $2.15 per mile, 5 cents lower than July

The September rolling average reflects just one day of activity, Sunday, September 1, but shows how much higher spot rates are to start the month compared to August:

- Van: $2.11 per mile

- Flatbed: $2.39 per mile

- Reefer: $2.23 per mile

Van Trends

Van load-to-truck ratios were notably strong and hit 3.0 as a national average on Wednesday, August 28. Van rates tend to rise when the ratio exceeds 2.5, which is where the average settled for the week.

Dorian’s effects on supply chains came late in the week and had little impact on national trendlines during the reporting period. Rates on 73 of DAT’s Top 100 biggest van lanes by volume were higher, 17 lanes declined, and 10 were neutral compared to the previous week.

While every major market east of the Mississippi River reflected stronger volumes last week, Memphis stood out with a 15% gain in available loads and an average outbound rate of $2.15 per mile, up 4 cents.

Reefer Trends

The national reefer load-to-truck ratio rose from 4.4 to 4.8 last week on the strength of apples and other tree harvests in the Pacific Northwest and Upper Midwest. Load-to-truck ratios jumped sharply in the Pendleton market (Yakima, Washington) and hit 23 on Friday, August 30, while Spokane, Washington, which includes Wenatchee, topped 34. The numbers are more stark at the ZIP code level: 988XX — Wenatchee— had 544 loads posted and just five trucks, while 989XX —Yakima—had 851 loads posted and 56 available trucks.

One indication of advance planning for Hurricane Dorian: Lakeland, Florida, outbound reefer volume was up 14% and the average outbound rate jumped 8 cents to $1.39 per mile. Lakeland to Atlanta increased 18 cents to an average of $1.38 per mile.

Key takeaways

- Spot freight volumes and rates were strong prior to any storm-related disruptions.

- It’s true that national average spot van rates in August were less than they were in July, but they were higher than both April ($1.80 per mile) and May ($1.79 per mile). Diesel fuel is 12 to 16 cents a gallon less than it was back then (spot rates factor a fuel surcharge calculation into the overall rate). Lower fuel costs are good news, especially for smaller carriers.

- If you have logistics resources to offer during hurricane recovery efforts, consider the American Logistics Aid Network. ALAN is a volunteer non-profit organization with a web portal where freight brokers, warehouses, and truck fleets can post available resources and aid organizations can post their needs. alanaid.org

DAT Trendlines is a weekly snapshot of month-to-date national average rates from DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $65 billion in annualized freight payments. DAT load boards average 1.2 million load searches per business day. For the latest spot market loads and rate information, visit dat.com/trendlines and follow @LoadBoards on Twitter.

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.