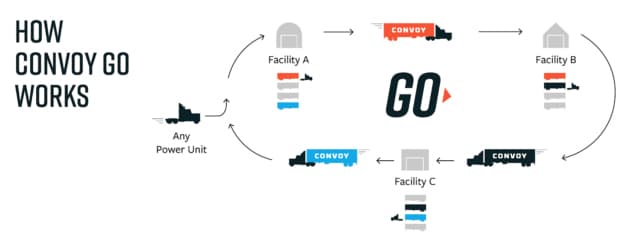

SEATTLE — Convoy, a nationwide trucking network and platform, has launched Convoy Go, a drop and hook marketplace that allows any carrier or owner-operator in the U.S. to start hauling pre-loaded trailers, and to operate at the same level as large asset-based carriers.

Drop shipments, or pre-loaded trailers, currently represent the majority of Fortune 500 company shipments.

To date, most of these shipments have been serviced by large asset-based carriers.

Convoy Go enables any carrier or owner-operator in the U.S. using the Convoy app to operate at the same level as large asset-based carriers, in terms of fleet utilization, service levels and access to shipments.

With its drop and hook marketplace, Convoy Go creates a seamless “grab and go” system, where carriers simply bring their power unit, pick up a pre-loaded trailer and hit the road, according to Tito Hubert, product lead for Convoy Go. To accomplish this, Convoy Go leverages its Universal Trailer Pool, a nationwide pool of Convoy-managed trailers that can be used by any driver in Convoy’s network, with no rental fees, he said.

“Convoy’s data shows that up to a third of the cost of truck freight in the U.S. is attributable to time spent either waiting for appointments, or waiting at the dock to load and unload,” Hubert said. “This massive amount of waste has a direct impact on increased transportation costs, decreased drivers’ earnings and reduced overall trucking capacity for shippers. We built Convoy Go to enable drivers to increase their productivity and earnings, all while providing shippers with greater capacity.”

He said Convoy Go reduces driver wait time in facilities from an average of three hours to less than an hour and provides five- to-10 hour appointment windows, offering drivers more flexibility to optimize their schedule.

Together, this translates into increases of carrier productivity of up to 50%. Carriers can find, book and complete a load, all using the Convoy app. Convoy’s Universal Trailer Pool is shared across all shippers and trucking companies, Hubert said.

Since Convoy initially piloted this offering in 2017, the company has worked with select shippers and thousands of drivers to tune the model across the Northeast, Southeast, South and West regions. Today, the program is available to all shippers and carriers nationwide.

Carriers, most of which are doing drop and hook loads for the first time, experience shorter wait times at facilities and flexible appointment windows, which translate directly into increased carrier productivity:

Convoy is a nationwide trucking network and platform striving to transform the $800B U.S. trucking industry. With Convoy, carriers get access to a free mobile app that allows them to find loads they want, save time, drive fewer miles empty, and get paid quickly. Hubert said shippers use Convoy’s data-driven insights and industry-leading service levels to book loads, improve their supply chain operations, lower costs, and reduce waste.

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.