PORTLAND, Ore. — Echoing previous weeks, load postings increased in a handful of key markets and are generally solid but fell 5% nationwide during the week ending October 27, according to DAT Solutions, which operates the industry’s largest electronic marketplace for spot truckload freight. Plentiful capacity pushed load-to-truck ratios lower and held rates in check.

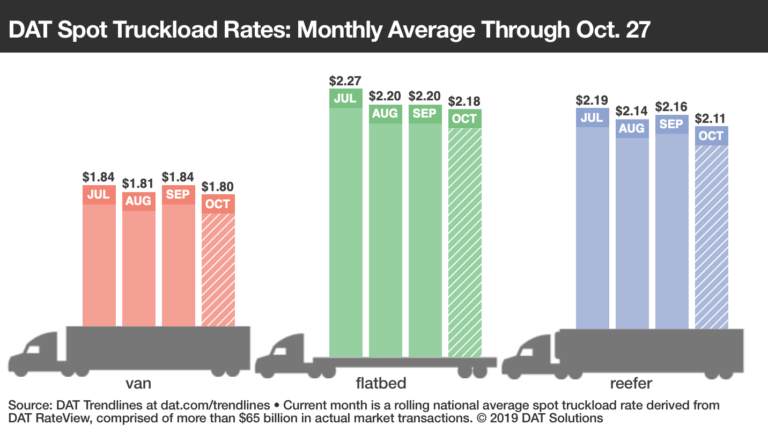

National Average Spot Rates for October (through October 27) included:

- Van: $1.80 per mile, 4 cents lower than the September average

- Flatbed: $2.18 per mile, 2 cents lower compared to September

- Reefer: $2.11 per mile, 5 cents lower than September

Van Trends

Spot van rates were higher on just 32 of DAT’s Top 100 largest van lanes by volume. While most markets were softer in terms of shipper demand for trucks, the number of van loads out of Los Angeles increased 8% and the outbound rate gained 2 cents to an average of $2.18 per mile. The load-to-truck ratio there touched 5.2 last Friday, a positive turn for carriers and perhaps a sign of better days ahead for fourth quarter imports.

Where rates were up: After Los Angeles, it’s a short list of markets where rates increased last week. Seattle, up 1 cent to $1.61 per mile, improved on last week’s modest gain, and Denver rose a penny to $1.19 per mile. While truckers would welcome higher rates, Seattle and Denver are perennial low-priced markets with sub-national-average outbound rates. On the downside, Columbus, Ohio, fell 1 cent to $2.08 per mile and is down 5% over the past four weeks. Lanes to watch:

- Los Angeles to Dallas, up 5 cents to $1.82 per mile

- Seattle to Spokane, Washington, up 17 cents to $3.09 per mile

- Philadelphia to Boston, down 14 cents to $3.26 per mile

Flatbed Trends

Spot flatbed rates have been slipping all month and the national average load-to-truck ratio has declined from nearly 15:1 during the first week of October to 9:1 last week.

Where rates were up: Phoenix, Tampa, Florida, and Harrisburg, Pennsylvania, may be on different sections of the map but they all had one thing in common: higher spot flatbed volumes. Loads from Harrisburg increased 6% compared to the previous week while Tampa and Phoenix gained roughly 4%. Lanes to watch:

- Houston to Wichita, Kansas, up 38 cents to $2.51 per mile

- Memphis, Tennessee, to Tulsa, Oklahoma, up 36 cents to $3.11 per mile

– Reno, Nevada, to Watsonville, California, up 39 cents to $3.53 per mile

This weekly spot-rate snapshot is derived from DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $65 billion in annualized freight payments. DAT load boards average 1.2 million load searches per business day.

For information go to www.dat.com/Trendlines.

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.