PORTLAND, Ore. — Load posts on the spot truckload market closed the month of October on a high note, gaining 16% during the week ending November 3, according to DAT Solutions, which operates the industry’s largest electronic marketplace for spot truckload freight.

Sustained higher volumes during October is a sign that holiday freight is starting to move. The number of truck posts fell 8%, which helped lift load-to-truck ratios and led to an increase in rates after several weeks of declines.

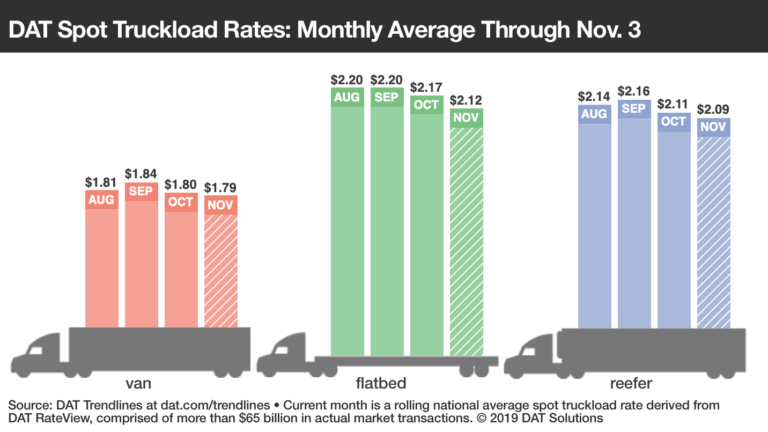

National average spot rates for October included:

- Van: $1.80 per mile, 4 cents lower than the September average

- Flatbed: $2.17 per mile, 3 cents lower compared to September

- Reefer: $2.11 per mile, 5 cents lower than September

Rates during the first three days of November were lower than October averages but were unchanged compared to the previous week: van, $1.79 per mile; flatbed, $2.12; and reefer, $2.09.

Van Trends

Spot van rates were higher on 59 of DAT’s Top 100 largest van lanes by volume. Two retail hubs for spot van freight — Los Angeles ($2.23 per mile, up 6 cents) and Columbus, Ohio ($2.14 per mile, up 7 cents) — paced rising markets.

Rates increased on van lanes into the Northeast, including:

- Chicago to Buffalo, New York, $2.59 per mile, up 14 cents

- Charlotte to Buffalo, $2.06 per mile, up 10 cents

Flatbed Trends

Spot flatbed rates dipped as volumes declined for the fifth consecutive week. The flatbed load-to-truck ratio averaged 10.8 in October, down from 14.7 in October 2018 and 37.5 in October 2017.

Christmas tree growers in North Carolina and Oregon, where six counties in the two states account for more than half of the 16 million trees harvested nationwide, are a big source of spot flatbed loads in November, but weakness from traditional sources—construction, oil and gas, machinery, agriculture—has caused the number of available loads to tumble.

Where flatbed rates were up: Houston, which averaged $2.30 per mile (down 7 cents), and other Texas markets have been hurt by a slowdown in oil and gas production and development. Key outbound lanes were lower:

- Houston to Wichita, Kansas, $2.03 per mile, down 48 cents after a 38-cent gain the previous week

- Houston to New Orleans, $2.37 per mile, down 28 cents

This weekly spot-rate snapshot is derived from DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $65 billion in annualized freight payments. DAT load boards average 1.2 million load searches per business day. For more information visit dat.com/Trendlines.

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.