PORTLAND, Ore. — National average spot van and refrigerated freight rates slipped again during the week ending April 13 as the number of load posts fell 4% while truck posts increased 3%.

The arrival of produce season in several southern markets failed to make up for the effects of more capacity in the spot market and bad weather across much of the country, said DAT Solutions, which operates the DAT network of load boards.

Here are the national average spot rates:

- Van: $1.83/mile, 2 cents lower than the March average

- Flatbed: $2.37/mile, 3 cents higher than March

- Reefer: $2.15/mile, 2 cents lower than March

Van trends

How soft are spot van rates? Pricing was lower on 76 of the top 100 van lanes last week. Only 23 lanes saw rates rise and one lane was neutral.

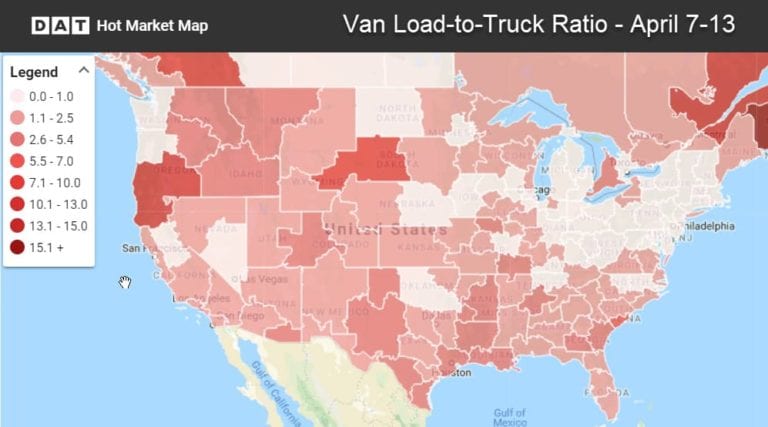

Van load-to-truck ratios have not held up after a promising start to April, with the national average sitting at 1.3 loads for every available truck. The good news is that load counts rose nearly 5% in Chicago and Houston, and more than 3% in Los Angeles last week—major markets for spot van freight.

Markets to watch: Outbound rates were down from Los Angeles, Columbus, Ohio, Philadelphia, and Charlotte, North Carolina. Charlotte to Allentown, Pennsylvania, gave up 13 cents to $2.08/mile, and rates fell on two Buffalo-inbound lanes: Columbus to Buffalo, down 19 cents to $2.66/mile, and Chicago to Buffalo, off 19 cents to $2.31/mile.

Reefer trends

Prices rose on 38 of the top 72 reefer lanes last week. Thirty-one lanes were lower and three were neutral. Higher volume in Florida and California was balanced out by lower volume from the Upper Midwest and Texas, which hurt spot reefer pricing overall.

Markets to watch: Lakeland, Florida, volumes spiked nearly 27% last week while the average outbound rate climbed 2 cents to $1.57/mile. Let’s see if Lakeland rates trace the pattern in Miami, where a big jump in volume two weeks ago was followed by a nice gain in the average outbound rate ($1.80/mile, up 13 cents). Meanwhile, several lanes from Florida and California produced strong rates:

- Fresno, California, to Denver up 40 cents to $2.24/mile

- Fresno to Boston gained 19 cents to $2.23/mile

- Miami to Baltimore up 29 cents to $2.00/mile

- Miami to Elizabeth, New Jersey, rose 15 cents to $1.82/mile

The Imperial Valley is underperforming for reefer freight: last week the average outbound rate from Ontario, California, was $2.51/mile, down 8 cents, on 9% lower volume.

DAT Trendlines are generated using DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $60 billion in freight payments. DAT load boards average 1.2 million load posts searched per business day.

For the latest spot market loads and rate information, visit dat.com/trendines and follow @LoadBoards on Twitter.

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.