PORTLAND, Ore. — National average spot truckload rates for vans, reefers and flatbeds slipped lower during the week ending March 2, said DAT Solutions, which operates the DAT network of load boards.

But high-traffic van lanes are looking up, especially on the West Coast, and rates on key flatbed lanes are starting to respond to increased construction and other activity:

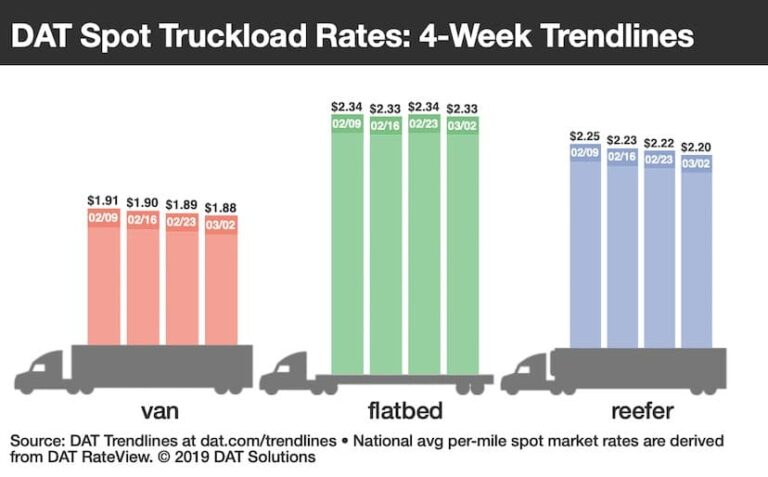

National average rates:

- Van: $1.88/mile, down 1 cent

- Reefer: $2.20/mile, down 2 cents

- Flatbed: $2.33/mile, down 1 cent

Compared to the previous week, the number of load posts on DAT MembersEdge was up 3 percent while truck posts fell 2 percent. The result? Higher load-to-truck ratios, usually a sign that rates are firming up.

National average load-to-truck ratios

- Van: 4.6 loads per truck, up from 4.3

- Reefer: 6.0, up from 5.5

- Flatbed: 25.7, up from 25.1

Van trends

Pricing on DAT’s 100 busiest van lanes by volume seems to have turned a corner thanks to improving activity at West Coast seaports. Van volumes from Seattle were up by double digits compared to the previous week, and several key van lanes moved higher:

- Seattle to Los Angeles increased 14 cents to $1.35/mile

- Seattle to Salt Lake City gained 13 cents to $1.84/mile

- Seattle to Spokane added 13 cents to $3.38/mile

Seattle is the closest seaport to China; look for activity from Los Angeles and other West Coast ports as goods there are processed and released in the coming weeks.

- National average spot flatbed rates have ticked up and down during the last month despite volumes being up 15 to 20 percent in February year over year. One reason: there’s more available flatbed capacity, both in the number of trucks on the road and the utilization of existing equipment. Lanes with big price increases last week:

- Reno, Nevada, to Los Angeles jumped 80 cents to $2.73/mile

- Roanoke, Virginia, to Cleveland gained 54 cents to $2.67/mile, possibly on the strength of steel shipments

- Cleveland to Milwaukee increased 50 cents to $4.38/mile

Oil-related freight movements from Houston are definitely in a lull. Texas has been experiencing freezing temperatures of late, even in South Texas, leading to lower rates. The average flatbed rate from Houston was $2.28/mile, a 3-cent drop compared to the previous week.

DAT Trendlines are generated using DAT RateView, which provides real• time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $60 billion in freight payments.

DAT load boards average 1.2 million load posts searched per business day.

For the latest spot market load availability and rate information, visit dat.com/trendlines and follow @LoadBoards on Twitter.

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.