PORTLAND, Ore. — After a 16% drop the previous week, spot truckload freight volume fell another 8% during the week ending July 28, according to DAT Solutions, which operates the industry’s largest network of load boards.

Higher load volume out of California prevented further decline, as the availability of summer produce soaked up van and refrigerated truckload capacity and kept trucks busy with longer hauls.

Nationally, the number of available trucks dipped 1.6% compared to the previous week. Average spot rates remain below June levels but ahead of May.

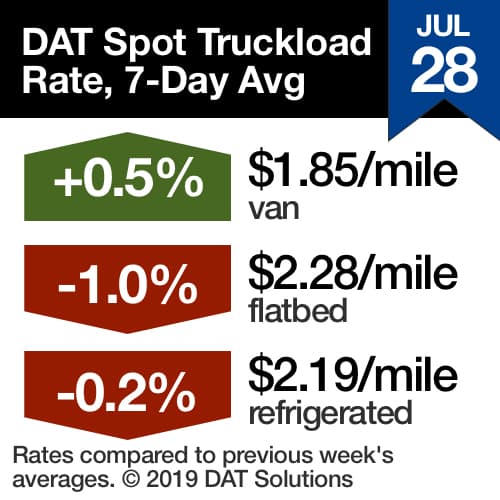

National Average Spot Rates through July 28 iincluded:

- Van: $1.85/mile, 4 cents lower than the June average

- Reefer: $2.19/mile, 7 cents lower than June

- Flatbed: $2.28/mile, 2 cents lower than June

Van trends

Van volume slipped 2% last week, and 68 of the top 100 van lanes had lower rates. However, Los Angeles volume jumped 6% and produce is running strong from the San Francisco and Fresno markets, although sufficient capacity is dampening the rate impact.

Where rates were rising:

The average outbound van rate from Seattle regained 3 cents to $1.43/mile, with two lanes up nicely:

- Seattle to Salt Lake City, up 18 cents to $1.84/mile

- Seattle to Spokane, Washington, up 8 cents to $2.98/mile

Reefer trends

Volume rose 4% nationwide and rates were higher on 35 of DAT’s top 72 reefer lanes. The San Francisco market, which includes the berry-producing areas around Salinas, California and Watsonville, California, has been a standout for summer produce. Last Friday, the load-to-truck ratio there hit 20.4.

Where rates were rising:

Load volume from Sacramento, California, jumped 12% compared to the previous week and the average outbound rate was up 8 cents to $2.86/mile. The number of reefer loads dropped sharply in U.S.-Mexico border markets, with Nogales, Arizona, plunging in both rates (down 15 cents to $2.01/mile) and volume. McAllen, Texas, lost volume but the average outbound rate held at $2.13/mile.

Flatbed trends

Spot flatbed rates normally peak in the second quarter, but this year they hit their high mark in early July. Since then the national average rate has slipped 3.5%.

Where rates were rising:

Load volume from Jacksonville, Florida, increased 22% last week and the average outbound rate was up 12 cents to $2.58/mile. Las Vegas rose 5 cents to $2.80/mile on a shift from north to south California shipping.

Key takeaways

- After a difficult spring, California’s summer and fall harvests have the potential to stabilize both reefer and van pricing in the coming weeks.

- For flatbed carriers, overcapacity remains the chief obstacle to pricing power. Trucks are readily available in many parts of the country.

- Seattle is growing in importance as a regional supply hub. The market, which includes the ports of Seattle and Tacoma, Washington, serves 11 of the top 20 fastest-growing employment markets in U.S. over the past five years.

DAT Trendlines is a weekly snapshot of month-to-date national average rates from DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $65 billion in annualized freight payments. DAT load boards average 1.2 million load searches per business day.

For the latest spot market loads and rate information, visit www.dat.com/trendlines and follow @LoadBoards on Twitter.

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.