The U.S. Class 8 sales market started 2021 with a strong January that saw sales of 17,164 units, according to data received from ACT Research. Compared to December, which is usually the best sales month of the year, January sales declined 20.9% from sales of 21,700. Compared to January 2020, however, sales increased by 7.4%.

Much of the increase came from sales of fifth-wheel-equipped road tractors. In January, 12,325 were sold, up 19.8% from 10,284 sold in the same month last year. Last January, 64.4% of the Class 8 trucks sold on the U.S. market were road tractors. This year, that figure rose to 71.8% of new trucks.

The remaining percentages of Class 8 trucks went to vocational purposes such as dump, concrete, trash hauling or other purposes.

“Those numbers aren’t seasonally adjusted,” said Kenny Vieth, president and senior analyst for ACT. “Normally, we’d expect around a 20% drop in sales from December to January, so this year is right in that ballpark.”

As 2020 began, the industry was expecting to deal with an overcapacity situation. Truck sales in 2019 far outpaced growth in freight availability, and experts were predicting there would soon be too many, causing rates to stagnate. Then came COVID-19.

With much of the country shut down due to the pandemic, e-commerce exploded as people who were stuck at home took to computers to order products. Spending hit bottom in April, but a round of stimulus checks from the government got people buying again. Soon there weren’t enough trucks rolling to handle it all, driving freight rates upward — and buyers snapped up available trucks to take advantage.

They’re still buying. In fact, they’re buying at a faster clip than the trucks can be built.

North American orders for new trucks in January were 42,309, down 1.8% from December orders but a whopping 146% higher than January 2020. That’s far more trucks than can be built in a month, increasing the backlog at manufacturing plants, which now stands at nearly six-and-a-half months.

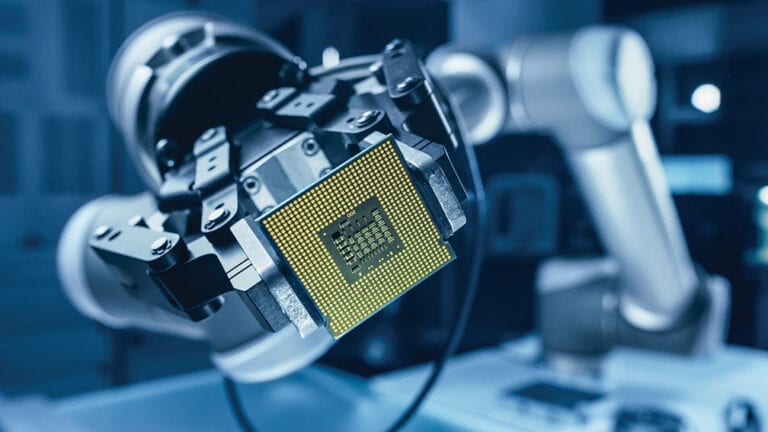

How soon that backlog can be addressed will depend on how quickly parts can be obtained. Global manufacturing has not yet fully awakened from COVID-19 shutdowns. One commodity in short supply is microchips, a problem impacting makers of vehicles of all sizes. Another is steel, with supplies dwindling as mills and foundries have stopped or slowed production due to the pandemic.

In “normal” times, U.S. truck manufacturers can produce about 27,000 Class 8 trucks per month. That number could already be reduced due to workforce availability and COVID-19 restrictions. Shortages of microchips and steel products could curtail production further.

In a Feb. 11 statement, Vieth noted, “While demand is strong, supply-chain impediments are accumulating, from steel production constraints created by global economic

reengagement during a pandemic, to silicon chip shortages, and in late January, the Mexican government ordering oxygen producers to give medical demand precedence over industrial supplies.”

Orders for new trailers followed a similar trajectory to trucks, with 29,100 ordered in January. That figure is down 33% from December order numbers but represents a 94% increase compared to January 2020. Production slots at trailer manufacturers are booked until late in the year. Trailer builders could suffer from shortages of parts, too, especially steel products.

Used Class 8 tractors also fell from December, by 8%, but ran 14% higher than January 2020. The average price of a used tractor was down with the average age and odometer reading up, according to ACT’s latest State of the Industry: U.S. Classes 3-8 Used Trucks report.

With the trucking industry poised for a year of growth and profit, fuel prices could provide a damper. The national average price for a gallon of diesel sat at $2.37 during election week last November, according to the U.S. Energy Information Administration (EIA). Since then, every week has brought another increase, up to $2.88 as of press time. That’s a 21.5% increase.

President Joe Biden’s administration plans to cancel pipeline construction, halt drilling on federal lands and restrict fracking operations — all of which will add to fuel costs over time.

Still, fuel surcharges offer protection from rising prices and the trucking industry won’t be impacted too severely.

On an individual basis, some manufacturers did better than others in the first month of the year, according to data received from Wards Intelligence.

January sales almost never exceed December’s, but that’s exactly what happened at Freightliner. The company sold 7,285 new, Class 8 trucks in January on the U.S. market, an increase of 306 units, or 4.4%, over December sales. Compared with January 2020, Freightliner sold 1,225 more trucks, a 20.2% increase.

Western Star’s 418 trucks sold in January trailed December sales of 494 by 15.4% and were 5.2% behind sales of 441 in January 2020.

Kenworth had an outstanding December with sales of 4,218, followed by a more normal January with 1,868 units moving in that month for a sales decline of 55.7%. Compared to January 2020 sales of 2,078, Kenworth sold 210 fewer units for a decline of 10.1%

Peterbilt sales also declined in January, dropping from 3,270 in December to 2,753 to start 2021, a 15.8% decline. Compared to January 2020, sales improved by 3.1%

Both of the PACCAR companies have introduced updated models for 2021. Peterbilt’s 579 model and Kenworth’s T680 both sport better aerodynamics, improved electronics and more.

Volvo sales declined by 13.5 % in January, with 1,746 trucks sold compared with 2,018 in December. Compared with January 2020, sales improved by 278 units, or 18.9%, in a solid start for the company.

Volvo-owned Mack Truck saw a sales decline of 1,068 trucks from December, from 2,150 to 1,082. Compared with January a year ago, however, Mack sales rose by 105 trucks (10.7%).

International sold 1,691 Class 8 trucks in January, a decline of 25.6% from December’s 2,272. Sales were also down from January 2020 sales of 1,939 for a decline of 12.8%. The company should be in for an interesting year as new owner Traton SE, formerly Volkswagen Truck and Bus, begins its first full year of ownership.

Traton also owns MAN and Scania brands in Europe, and Resende, Brazil-based Volkswagen Truck and Bus, with 2020 sales of about 242,000 vehicles. Look for powertrain components developed by MAN and Scania engineers to make their way into the International lineup.

With a strong start and plenty of orders on the books, it’s looking like a strong 2021 for U.S. sales of Class 8 trucks.

Cliff Abbott is an experienced commercial vehicle driver and owner-operator who still holds a CDL in his home state of Alabama. In nearly 40 years in trucking, he’s been an instructor and trainer and has managed safety and recruiting operations for several carriers. Having never lost his love of the road, Cliff has written a book and hundreds of songs and has been writing for The Trucker for more than a decade.