LITTLE ROCK, Ark. — For the first time in months, the average price for a gallon of diesel fuel across the nation has dropped below $5.

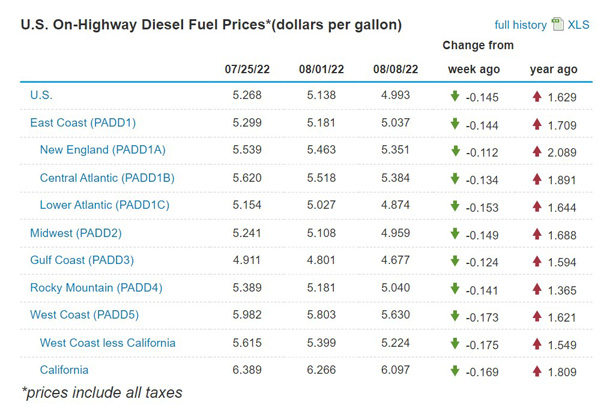

According to the U.S. Energy Information Administration (EIA), the price sits at $4.99.

Nationwide average diesel prices reached a peak of $5.72 per gallon on June 20, according to EIA data. During that same week, diesel prices averaged $6.92 in California, with multiple retailers charging over $7 per gallon.

During this same week of 2021, a gallon of diesel sold for $3.29. A year before that it was $2.42.

Around the nation, the highest prices for diesel can be found in California at just over $6 a gallon.

The lowest price can be found in the Lower Atlantic region, where a gallon of diesel is $4.80 per gallon on average.

Carriers large and small have had issues coping with higher fuel costs.

“It’s been rough,” said Ronnie Watts, who owns a fleet of four logging trucks in Arkansas. “When you have to fill up those trucks with sky-high fuel but your profits aren’t going up, you have to make some tough choices.”

Meanwhile, benchmark U.S. crude oil for September delivery rose $1.75 to $90.76 a barrel Monday.

Brent crude for October delivery rose $1.73 to $96.65 a barrel.

Prices at the pump might be lower now, but the longer-term outlook for oil suggests low inventories will keep prices elevated.

“Russia-Ukraine is a factor but… we had tight supplies coming into this,” Rob Haworth, senior investment strategist at U.S. Bank Wealth Management, told CNN recently. “We’d love to see the conflict in Russia and Ukraine end. But I think we still are faced with a global economy that is short of oil in the near term.”

Combining higher fuel cost with lowered freight rates on the spot market can have devastating results on the smallest carriers.

As The Trucker has previously reported, spot rates are trending downward, while carriers who negotiated new contract rates with their customers are seeing those efforts pay off.

The 2.7% increase in June follows a 0.3% May increase. The American Trucking Association’s (ATA) June index equaled 120.1, putting the month 20.1% ahead of the 2015 baseline used by ATA.

On a seasonally adjusted basis, the June result was the 10th straight year-over-year gain.

The Cass Freight Index, which measures shipping volumes and expenditures from multiple modes of transportation, declined 2.6% in June from May values. Compared to June 2021, freight volumes fell 2.3%.

The Cass release indicates shipments have been down four of the six months reported this year and notes that inventory has shifted from “a major tailwind” to a more neutral posture but could become a headwind later this year. That’s an indication that retailers and manufacturers that previously couldn’t get enough products have reached inventory levels and slowed ordering for new products. Decreased consumer demand, fueled by inflation, has caused reductions in shipping orders.

The Cass Freight Index measures freight hauled by rail, truck, ship, barge, pipeline and air.

In FTR’s “Mid-Year Lookaround,” released on June 30, Steve Graham, analyst at FTR, said, “We are living in strange times. First, a 100-year pandemic that brought out the best and worst of humanity. Some of the policy responses could be up for debate.”

He cautions that we should not ignore the reality of inflation. He also mentioned recession, saying, “The probability of a recession emerging in the next year is about even, or 50/50.”

According to the latest “Trendlines” report from DAT Services, spot loads posted in June on the country’s largest load board declined by 20.2% from May; in June 2021, the decline was 26%. A decline of more than one-fifth of the number of posted loads in only one month is huge.

Fewer loads means more competition for the loads that remain — and lower rates too.

Spot rates for van freight declined 0.9% in June from May rates but are still 0.5% higher than they were in June 2021, just a year ago.

Flatbed rates peaked a little later than van and refrigerated rates on the DAT board. For June, they were 0.1% lower than in May but were still 9.5% higher than June 2021. Refrigerated rates declined a full percentage point from May and were 1.6% lower than in June 2021.

For small trucking companies like Watts’s, the hope is that fuel prices at least find a plateau somewhere below $5 a gallon.

“It can mean the difference between staying in business or shutting it all down,” he said. “I’d rather not shut things down. I have a family to feed.”

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.