GREEN BAY, Wis. — Schneider National has announced financial results for this year’s third quarter.

“Our enterprise experienced year-over-year declines in revenue and earnings in the third quarter, a period which we believe represents the most challenging phase of this prolonged freight recession,” said Mark Rourke, president and chief executive officer of Schneider. “Our results were driven by ongoing price pressures primarily in our network businesses, as well as other headwinds such as fuel, bad debt, and lower equipment gains.”

Rourke said that “Though we are feeling the effects of the current environment across the business, our performance is augmented by our platform diversity that we have strategically advanced over the past several years.”

He said the company is actively onboarding new dedicated business within its truckload segment, and while this startup activity is accompanied by near-term friction costs, “we are pleased with the growth and contributions of this key component of our portfolio.”

Dedicated, with the addition of M&M Transport this quarter, now comprises more than 60% of Schneider’s total truckload fleet, Rourke said.

“In Intermodal, our complementary rail partnerships are providing synergistic and compelling service and transit times,” he added. “Our Logistics segment continues to drive new business into the Enterprise through both brokerage and Power Only services while effectively managing through challenging market conditions. As we navigate the late stages of the current freight cycle, we are preparing our business for the inevitable market recovery and advancing our strategic growth objectives for Dedicated, Intermodal, and Logistics.”

Results of Operations (unaudited)

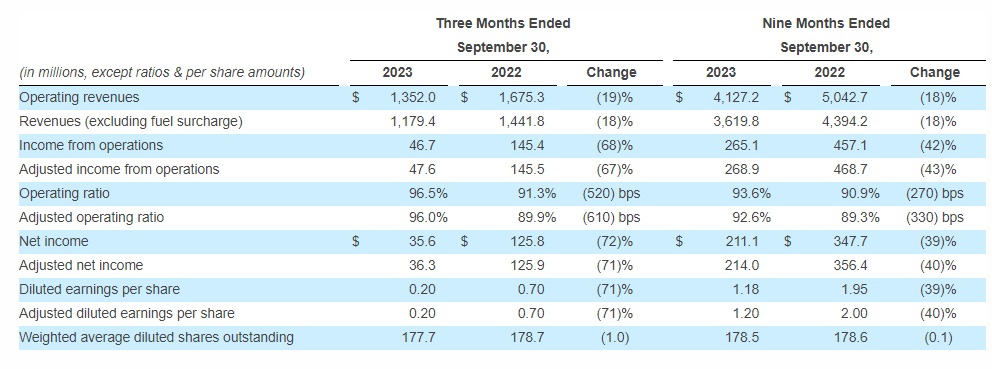

The following table summarizes the company’s results of operations for the periods indicated.

Enterprise Results

Enterprise net income for the third quarter of 2023 was $35.6 million, a decrease of $90.2 million, or 72%, compared to the same quarter in 2022. The company recorded net gains on equity investments of $2.3 million compared to $25.9 million in the third quarter of 2022, which is reflected in Other expense (income) – net on the income statement.

At September 30, 2023, the company had a total of $289.0 million outstanding on various debt instruments compared to $215.1 million as of December 31, 2022. The company had cash and cash equivalents of $58.5 million and $385.7 million as of September 30, 2023 and December 31, 2022, respectively. The company’s effective tax rate was 22.8% in the third quarter, compared to 25.0% in the same quarter of the prior year.

In February 2023, the company announced the approval of a $150.0 million stock repurchase program. As of September 30, 2023, the company has repurchased $50.6 million under the program year to date. In July 2023, the company’s Board of Directors declared a $0.09 dividend payable to shareholders of record as of September 8, 2023. This dividend was paid on October 10, 2023. On October 30, 2023, the company’s Board of Directors declared a $0.09 dividend payable to shareholders of record as of December 8, 2023, expected to be paid on January 8, 2024. As of September 30, 2023, the company had returned $47.7 million in the form of dividends to shareholders year to date.

Results of Operations – Reportable Segments

Truckload

Truckload revenues (excluding fuel surcharge) for the third quarter of 2023 were $535.3 million, a decrease of $35.9 million, or 6%, compared to the same quarter in 2022.

Results were driven by unfavorable pricing in network, partially offset by the impact of organic dedicated growth and M&M Transport revenues. The impact of productivity improvements were more than offset by pricing declines in the quarter. Truckload revenue per truck per week was $3,909, a decrease of 6% compared to the same quarter in 2022.

Revenue per truck per week in network decreased 16%, while revenue per truck per week in dedicated increased 2%, compared to the same quarter in 2022.

Truckload income from operations was $24.5 million in the third quarter of 2023, a decrease of $58.7 million, or 71%, compared to the same quarter in 2022 due to lower price in network, higher fuel and other inflationary costs, bad debt, and friction costs related to dedicated new business implementations. Truckload operating ratio was 95.4% in the third quarter of 2023, compared to 85.4% in the third quarter of 2022.

Intermodal

Intermodal revenues (excluding fuel surcharge) for the third quarter of 2023 were $263.0 million, a decrease of $71.7 million, or 21%, compared to the same quarter in 2022 driven by lower revenue per order and volume, which decreased 16% and 9%, respectively, compared to the third quarter of 2022.

Intermodal income from operations for the third quarter of 2023 was $11.1 million, a decrease of $20.0 million, or 64%, compared to the same quarter in 2022, due to negative pricing and volume pressures, partially offset by lower rail and dray-related costs. Intermodal operating ratio was 95.8% in the third quarter of 2023, compared to 90.7% in the third quarter of 2022.

Logistics

Logistics revenues (excluding fuel surcharge) for the third quarter of 2023 were $326.0 million, a decrease of $138.2 million, or 30%, compared to the same quarter in 2022 primarily due to decreased revenue per order, which continues to be unfavorably impacted by lower market prices, and lower brokerage volumes which decreased 11% year over year.

Logistics income from operations for the third quarter of 2023 was $8.5 million, a decrease of $19.4 million, or 70%, compared to the same quarter in 2022 due to lower volumes and net revenue per order, and decreased port dray earnings. Logistics operating ratio was 97.4% in the third quarter of 2023, compared to 94.0% in the third quarter of 2022.

Business Outlook

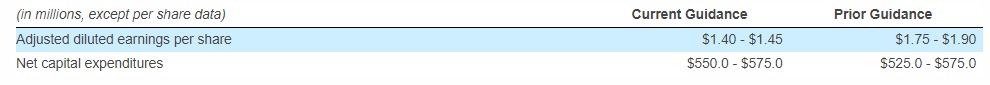

“Our second half 2023 earnings are clearly challenged by ongoing pricing pressures, muted seasonality, and transitory cost items,” said Darrell Campbell, executive vice president and chief financial officer at Schneider. “We are intently focused on margin restoration particularly in our network businesses, which includes the proactive execution of pricing strategies and positioning our Enterprise for improving market conditions, which we expect to materialize in the first half of 2024. Our updated guidance for full year 2023 adjusted diluted EPS is $1.40 – $1.45 and for net capital expenditures is a range of $550 – $575 million, with a full year effective tax rate estimated at 24.5%.”

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.