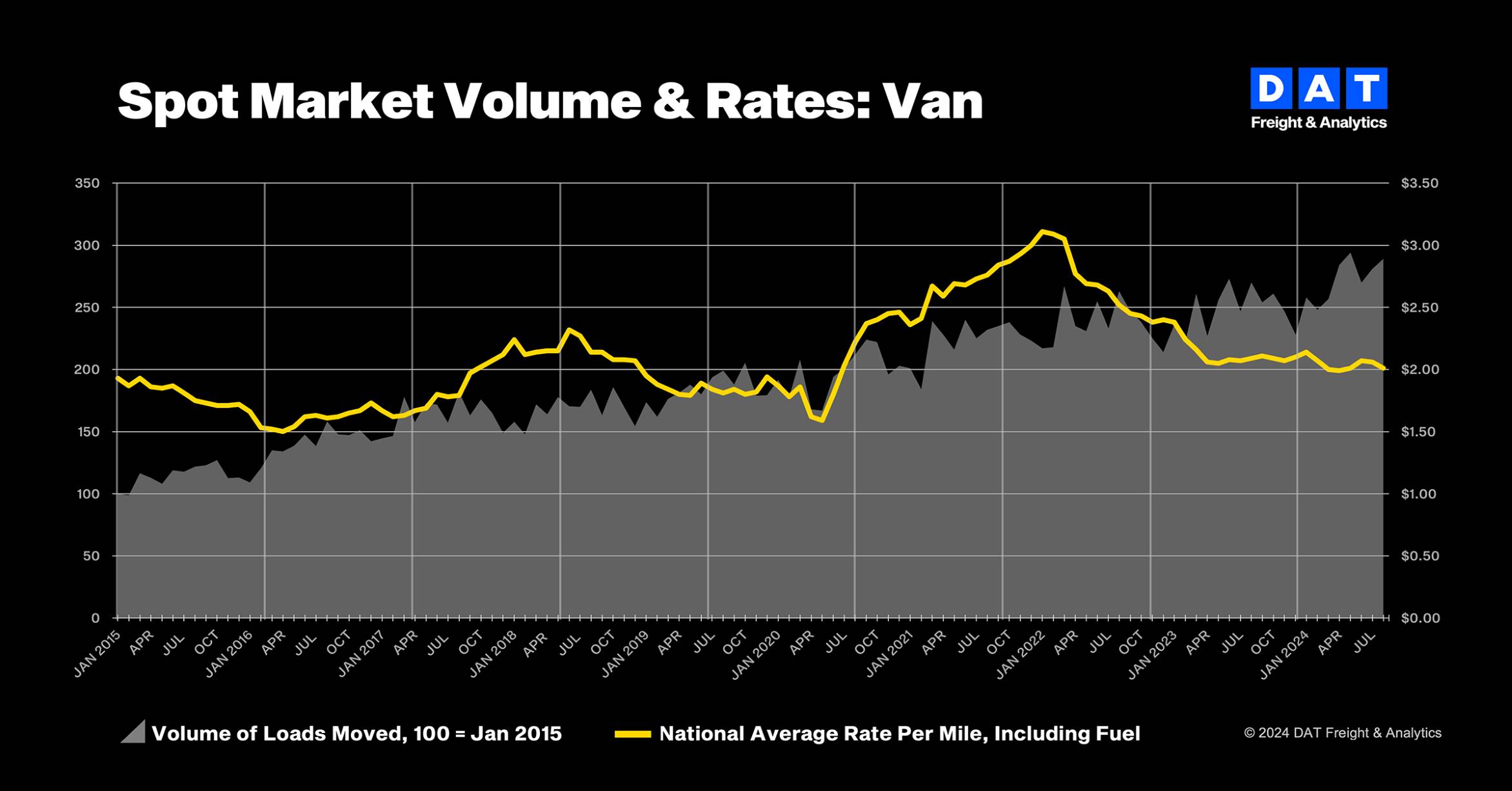

BEAVERTON, Ore. — Truckload freight volumes and rates continued on divergent paths in August, with shipments rising and prices falling for the third straight month, according to information released by DAT Freight & Analytics.

The DAT Truckload Volume Index (TVI), an indicator of loads moved in a given month, increased month over month for all three equipment types in August:

- Van TVI: 289, up 2.8%

- Refrigerated TVI: 220, up 4.3%

- Flatbed TVI: 287, up 0.3%

Year over year, the TVI was higher for both van and refrigerated freight, with van TVI up 6.3% and refrigerated up 17.6%. The flatbed TVI dipped 0.7% from August 2023.

Meanwhile, August lived up to its reputation as a tough month for truckload rates.

“Linehaul rates were year-over-year positive for the first time since March 2022, a trend that should continue into the fall shipping season,” said Ken Adamo, DAT’s chief of analytics. “However, year-over-year comparisons are little consolation for truckers looking for better pricing now.”

Spot and contract rates declined in August.

National average spot truckload rates declined for all three equipment types compared to July:

- Spot van: $2.01 per mile (down 5 cents)

- Spot reefer: $2.41 a mile (down 4 cents)

- Spot flatbed: $2.41 a mile (down 7 cents)

The average van linehaul rate was $1.60 a mile, down 3 cents month over month but 3 cents higher than August 2023. The refrigerated rate fell 2 cents to $1.96, 1 cent higher year over year. The flatbed rate tumbled 5 cents to $1.92, still 2 cents higher year over year. Linehaul rates subtract an amount equal to an average fuel surcharge.

National average rates for freight moving under long-term contracts also dropped compared to July:

- Contract van rate: $2.40 per mile, down 3 cents

- Contract reefer rate: $2.74 a mile, down 7 cents

- Contract flatbed rate: $3.08 a mile, down 3 cents

Monthly average contract rates for all three equipment types have been year-over-year negative since August 2022, reinforcing the protracted pricing challenges of truckload carriers. Approximately 85% of all truckload freight moves under contract.

Load-to-truck ratios fell.

National average load-to-truck ratios turned lower for all three equipment types:

- Van ratio: 3.6, down from 4.2 in July, meaning there were 3.6 loads for every van truck on the DAT One marketplace

- Reefer ratio: 6.0, down from 6.5

- Flatbed ratio: 9.8, down from 11.9

Load-to-truck ratios reflect truckload supply and demand on the DAT One marketplace and indicate the pricing environment for spot truckload freight.

Linda Garner-Bunch has been in publishing for more than 30 years. You name it, Linda has written about it. She has served as an editor for a group of national do-it-yourself publications and has coordinated the real estate section of Arkansas’ only statewide newspaper, in addition to working on a variety of niche publications ranging from bridal magazines to high-school sports previews and everything in between. She is also an experienced photographer and copy editor who enjoys telling the stories of the “Knights of the Highway,” as she calls our nation’s truck drivers.