COLUMBUS, Ind. — The latest release of ACT’s For-Hire Trucking Index showed nearly across-the-board declines, with capacity being the lone exception.

The Pricing Index fell considerably to 38.8, in May on a seasonally adjusted (SA) basis, the lowest in survey history, from 45.4 in April.

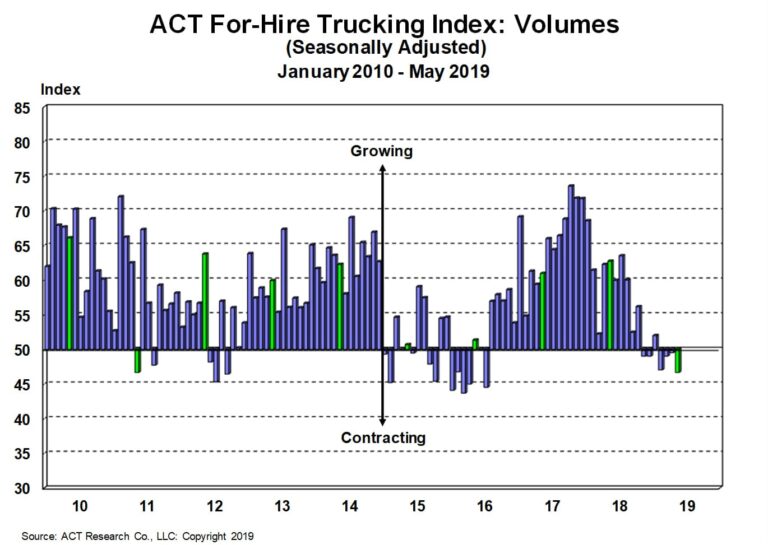

The Volume Index dropped further into negative territory hitting 46.7 (SA), from 49.5 in April. Fleet productivity/utilization slipped to 46.0 in May on a seasonally adjusted basis down from 49.4 in April, and capacity growth increased to 54.6, from April’s 54.3 reading.

“May’s Pricing Index was the fourth consecutive negative number after 30 straight months of expansion. This confirms our expectation that the annual bid season is not going well for truckers,” said Tim Denoyer, ACT Research’s vice president and senior analyst. “We continue to believe rates are under pressure from weak freight volumes and strong capacity growth.”

Volume in May fell for the sixth time in the past seven months, Denover said.

“The softness coincides with several other recent freight metrics, with the drop likely due in part to rapid growth of private fleets and the slowdown in the industrial sector of the economy,” he said. “The supply-demand balance reading loosened to 42.1, from 45.3 in April. The past seven consecutive readings have shown a deterioration in the supply-demand balance, with May the largest yet.”

The ACT Freight Forecast provides quarterly forecasts for the direction of volumes and contract rates through 2020 and annual forecasts through 2021 for the truckload, less-than-truckload and intermodal segments of the transportation industry.

For the truckload spot market, the report provides forecasts for the next 12 months.

ACT is a publisher of new and used commercial vehicle (CV) industry data, market analysis and forecasting services for the North American market, as well as the U.S. tractor-trailer market and the China CV market. ACT’s CV services are used by all major North American truck and trailer manufacturers and their suppliers, major trucking and logistics firms, as well as the banking and investment community in North America, Europe, and China.

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.