WESTLAKE, Ohio — The TA Restaurant Group, a division of TravelCenters of America, is opening a Black Bear Diner at the TA travel center in Kingman, Arizona, off Interstate 40 at Exit 48. Black Bear Diner was recognized in Nation’s Restaurant News 2017 and Nation’s Restaurant News 2018 as one of the fastest growing private restaurant chains in the United States.

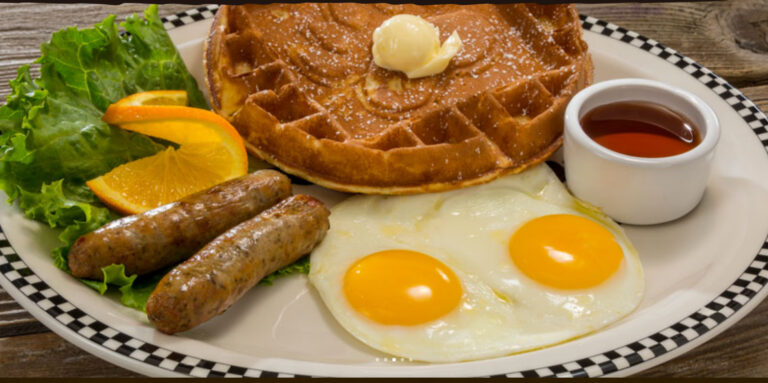

The full-service dining concept offers breakfast, lunch and dinner. Breakfast is served 24 hours a day.

“We’ve been thrilled with the popularity and success of the Black Bear Diners among our customers and are happy to add yet another to our restaurant group,” said John Ponczoch, senior vice president, TA Restaurant Group. “We strive to provide a ‘home away from home’ experience for all our customers and these restaurants provide a dining option that is unique and welcoming, with the comforts of home.”

“We are extremely pleased with the TA Restaurant Group’s opening in Kingman, Arizona, their fourth franchised Black Bear Diner,” said Bruce Dean, co-founder and chief executive officer of Black Bear Diner. “As an experienced and successful operator with thriving Black Bear Diners in Wheeler Ridge, California, Barstow, California, and in Beaumont, Texas, we look forward to the continued growth of this important franchise partnership.”

All Black Bear Diner restaurants offer a bear-themed atmosphere and are designed to remind guests that quality and service are key ingredients to every meal, Dean said. The restaurant is open daily from 6 a.m. to 10 p.m. and has seating for approximately 150 people.

This is the fourth Black Bear Diner in the TA travel center network.

TravelCenters of America is the nation’s largest publicly traded full-service travel center network. Founded in 1972 and headquartered in Westlake, Ohio, its more than 21,000 employees serve customers in over 260 locations in 44 states and Canada, principally under the TA, Petro Stopping Centers and TA Express brands.

For more information, visit www.ta-petro.com.

Founded in Mt. Shasta, California, in 1995, Black Bear Diner now operates 135 locations in 13 states and growing. country. For a full menu and additional information, please visit www.blackbeardiner.com.

Wheeler Ridge, California

Barstow, California

Beaumont, Texas

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.