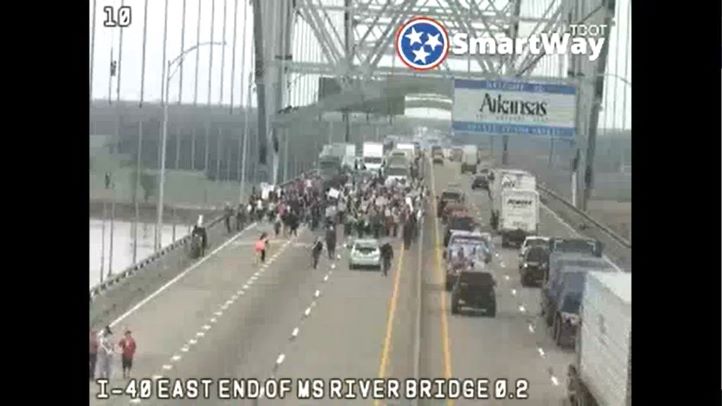

LITTLE ROCK, Ark. — Arctic weather brought more misery to much of the U.S. on Saturday, especially for people unaccustomed to such bitter cold in places like Memphis, Tennessee, where residents were urged to boil water and some had no water at all after freezing temperatures broke water mains across the city. Temperatures weren’t expected to rise until after the weekend. About two hours west of Memphis in Little Rock, Arkansas, truck driver Lacey Daniels let out a long “Brrrrr” as she filled up her tanks for a trip out west to California. The diesel islands felt like icebergs as the wind whipped through. “I never knew the south could be so cold!” she exclaimed. “This is crazy!” Daniels, who is originally from Wisconsin, said she had hoped the trip down south would mean warmer weather. “I guess I won’t be needing my bikini,” she said, laughing. Daniels stopped along Interstate 40 in Arkansas’s capital on Saturday night along with dozens of her fellow truck drivers — all doing their best to stay warm as they stepped out of their toasty cabs into the frigid air for fuel and other necessities. Kevin Barnhardt said he just drove in from Michigan, where his in-cab thermometer read -15 that morning. “When it’s this cold, you really have to be careful,” he said. “It can be deadly, especially if you aren’t prepared. The bracing cold followed a week of storms blamed for at least 67 deaths around the U.S., many involving hypothermia or road accidents. At the Four Way Grill in Memphis, owner Patrice Bates Thompson said the water problems have closed their soul food kitchen for days. “This is our staple, and this is what basically drives the force of my family financially,” Thompson told Fox-13 Memphis. “We depend on business, and we have been at home.” So many pipes broke in Memphis that water pressure fell throughout the city. Concerned about possible contamination, Memphis Light, Gas & Water urged its more than 400,000 customers to boil water for drinking or teeth-brushing or use bottled supplies on Saturday while crews worked around the clock to make repairs. “Our production and treatment of water is working well,” the utility said in an email. “We cannot give restoration estimates until all leaks are identified.” The utility said more than 100 employees volunteered Saturday to identify breaks, and residents were urged to report leaks in the street, at homes and in unoccupied buildings. Without water since Thursday morning, Pamela Wells was visited Saturday by a worker who asked whether they had a leak. “My husband said, ‘How can we have a leak, if we don’t have any water?’” she said. They had filled a bathtub with water to flush toilets with when they noticed the pressure dropping, Wells said. For everything else they were using a dwindling supply of bottled water until their street became passable on Saturday and friends brought in fresh supplies. “It’s been a struggle,” she said, recalling how they lost water for a 10-day stretch in December 2022. “You don’t know how long it’ll be out.” Meanwhile, the Memphis City Council opened seven bottled water distribution stations on Saturday, one in each council district. Two others were operating at fire stations. One had 300 cars lined up when it opened on Saturday, Shelby County Emergency Management Director Brenda Jones said in a telephone interview. “You have people with absolutely no water, people with low water pressure, and you have the boil water advisory,” she said. A huge swath of the U.S. was under wind chill advisories, from Montana into central Florida. It was particularly harsh in the Midwest. The wind made it feel like minus 16 degrees in Iowa City on Saturday, and overnight wind chills hovered around zero in Oklahoma City, where David Overholser sought shelter at the non-profit Homeless Alliance. “Being 63 and from Florida originally, I don’t like cold. I can’t handle it,” Overholser told The Oklahoman. “It’s been very, very rough and painful and I just, you know, try to hang on one day, one hour at a time … it’s definitely scary.” Wind chills dipped to minus 20 Fahrenheit early Saturday in Vermont, where the Stowe Mountain Resort urged hardy skiers to “bust out all the stuff you need to hang on the mountain safely, take frequent warm up breaks inside, and keep a close eye on each other for signs of frostbite.” Snow tapered in the Northeast after blanketing a large area including Washington and New York City. In New York, aid groups distributed food and clothes near an elementary school Saturday to migrants who bundled up in thick coats and knit caps to ward off the freezing temperatures. More snow was coming to West Virginia, where the weather service predicted up to 4 more inches (10 centimeters) Saturday, along with winds gusting to 40 mph (64 kph), driving wind chills down to 20 below zero. More lake-effect snow pounded northwestern Indiana Friday into Saturday, creating near white-out conditions near Lake Michigan and making the busy highway corridor in and out of Chicago treacherous. “We’re kind of taking a chance — rolling the dice,” Frank Finney told WBBM-TV. Finney and his family were navigating Interstate 94 through Michigan City to La Porte, Indiana. Tennessee alone recorded 26 deaths, including a 25-year-old man found dead on the floor of a mobile home in Lewisburg after a space heater overturned and turned off, said Bob Johnson, chief deputy for the Marshall County Sheriff’s Office. “There was ice on the walls in there,” Johnson said. On the West Coast, more freezing rain was forecast Saturday in the Columbia River Gorge and the area was expected to remain near or below freezing through at least Sunday night. Trees and power lines already coated with ice could topple if they get more, the National Weather Service warned. “Stay safe out there over the next several days as our region tries to thaw out,” the weather service said. “Chunks of falling ice will remain a hazard as well.” Thousands have been without power since last weekend in parts of Oregon’s Willamette Valley because of storm damage. Despite work by repair crews, about 25,000 customers were without electricity in Oregon on Saturday, according to the website poweroutage.us. The weather service forecast above-average temperatures across most of the country next week. Meanwhile, not everyone hated the white stuff. “It’s fun right now,” Michigan City resident Andrew Smith told WBBM-TV. “We haven’t had this much snow in a minute, and Christmas wasn’t snowy, so it’s fun to do this. I can play with the kids, make snowballs, make a snowman.” The Trucker Staff contributed to this report.