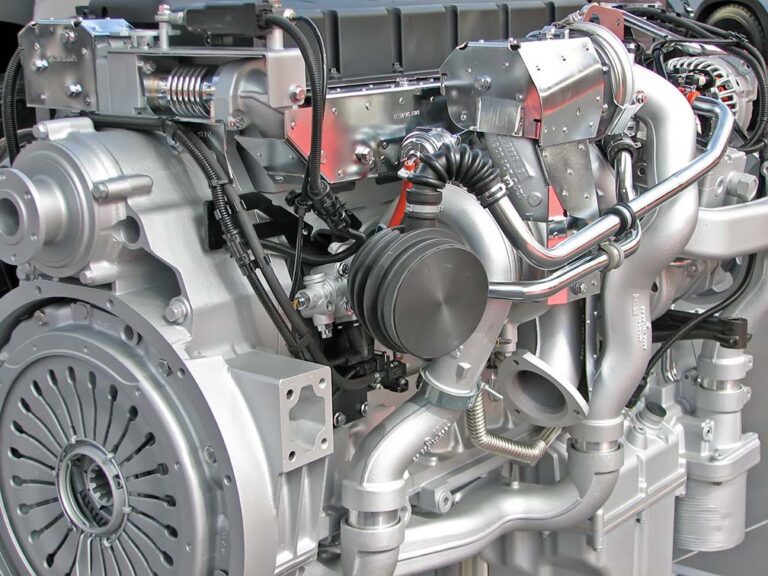

GREENSBORO, N.C. — Volvo Trucks North America customer Rockview Farms has deployed two Volvo VNR (Volvo North American Regional) Electric trucks to support farm-to-customer deliveries of local California milk. The zero-tailpipe emissions battery-electric trucks “will help reduce noise and emissions in the neighborhoods surrounding Rockview Farms’ facility in Downey, California, which is the central hub for deliveries throughout the greater Los Angeles area,” according to a news release. Rockview Farms’ Volvo VNR Electric trucks are the final two trucks to be funded through the award-winning Volvo LIGHTS project. “Volvo Trucks commends Rockview Farms for being a good neighbor that has long demonstrated their commitment to the local community, which they are continuing to support by deploying zero-emission Volvo VNR Electric trucks for their local routes,” Peter Voorhoeve, president of Volvo Trucks North America, said. “Delivering these two trucks to Rockview Farms is a nice closure to the successful Volvo LIGHTS project, which was focused on providing a range of benefits — cleaner air, reduced noise, workforce development opportunities, and more — to Southern California communities through freight electrification.” Volvo Trucks deployed its first Class 8 Volvo VNR Electric trucks to fleet operators in 2019 as part of the Volvo LIGHTS project. Over the next several years, Volvo Trucks North America, South Coast Air Quality Management District and 12 other organizations designed and implemented a blueprint for the complete ecosystem needed to deploy commercial battery-electric freight trucks, eventually deploying more than 30 in California’s South Coast Air Basin. “Our Downey facility is surrounded by neighborhoods, and as Southern California’s hometown dairy since 1927, we strive to be a good neighbor in our hometown. We were excited to receive funding for the Volvo VNR Electric trucks to help reduce emissions from our daily operations, while also reducing noise, as the battery-electric trucks are very quiet,” Curt DeGroot, owner of Rockview Farms, said. “Our drivers love them for those same reasons. We’ve had to keep the same drivers on the trucks, because once they drive the Volvo VNR Electric trucks, they don’t want to go back to driving anything else.” The Volvo VNR Electric model produces zero-tailpipe emissions and significantly reduces heat, noise and vibrations, TEC Equipment–La Mirada, a Volvo Trucks Certified Electric Vehicle Dealer, provides ongoing training to Rockview Farms drivers to help them understand how to optimize the range of the Volvo VNR Electric, including how to leverage regenerative braking benefits to add power back to the battery. The dealership also utilized a route planning tool, the Electric Performance Generator, to help Rockview Farms evaluate the routes that were best suited for its Volvo VNR Electric trucks, taking into consideration the vehicle configuration and battery capacity, environmental factors such as terrain and ambient temperature, and specific route details, including traffic patterns. In addition to supplying grocery stores in Southern California, the battery-electric trucks supply cruise ships at the Port of Long Beach four times a week. Rockview Farms is currently evaluating the trucks to see how they perform on their current routes and has already identified 10 additional local routes that could be a good fit for electrification. Rockview Farms is building out high-powered charging infrastructure at its Downey facility to support the battery-electric Volvo VNR Electric trucks with funding from Southern California Edison (SCE)’s Charge Ready Transport program. Once complete, the infrastructure will also charge the batteries for its electric transport refrigeration units. The facility is currently utilizing temporary 75kW chargers to support the Volvo VNR Electric trucks and two planned electric yard trucks. To learn more about Volvo Trucks North America and the Volvo VNR Electric, visit the company website.