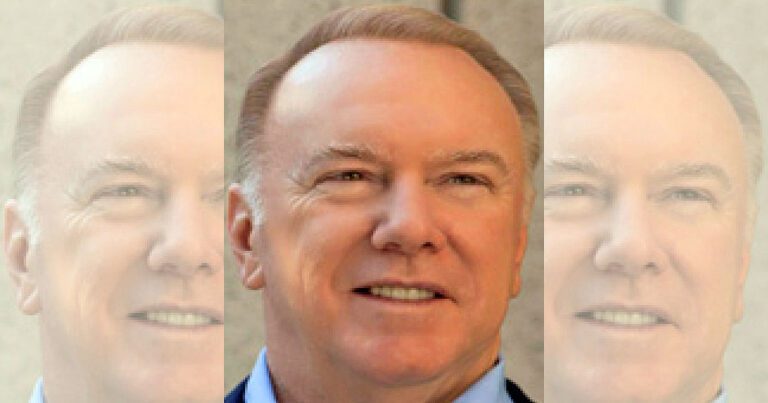

Exactly what defines a worker as an independent contractor? That’s what the U.S. Department of Labor (DOL) is trying to determine with a proposed rulemaking about independent contractors under the Fair Labor Standards Act (FLSA). On Oct. 13, 2022, the DOL published its notice of proposed rulemaking, which seeks to provide guidance on classifying workers and to combat what the department labels “employee misclassification.” What do these proposed rules mean for the trucking industry, and would they be in line with California’s Assembly Bill 5 (AB5), which has caused many companies to stop hiring independent contractors from that state? “When you look at everything, they’re still independent contractors,” stated Darrel Hopkins, controller for Prime Inc. He believes the proposed rules look more like “wordsmithing of what’s already there” rather than a change that would drive more independent contractors away from the trucking industry. In other words, the DOL’s proposed change is not dramatically different from current laws. The biggest change would be the rescinding of the 2021 Independent Contractor Rule. This rule, put in place during the final days of former President Donald Trump’s administration, issued an “economic realities test” that focused on two factors. The first factor was the nature and degree of the individual’s control over their work. “If an individual exercises substantial control over key aspects of the work performance, such as their schedule, selection of projects and ability to work for others, that individual would likely be considered an independent contractor,” according to the 2021 rule. “If, however, the individual did not exercise such control, they would likely be considered an employee under the FLSA.” The second factor focused on an individual’s opportunity for profit or loss. “If an individual had the opportunity to earn profits and incur losses based on the exercise of his or her own initiative or management of his or her own investment on helpers or equipment to further their work, that individual would likely be considered an independent contractor,” according to the 2021 rule. “If, however, an individual did not possess these opportunities, they would likely be considered an employee under the FLSA.” Essentially, the proposed changes by the DOL would turn the clock back to a standard that was in place in 2020. “As we continue to examine every line of the DOL’s proposal, we appreciate that the rule stresses a classification decision should be based on all the circumstances in each specific case,” noted Todd Spencer, president of the Owner-Operator Independent Drivers Association. “However, we have concerns with provisions that could ignore specific aspects of the trucking industry and wrongfully deny owner-operators the chance to continue working as independent contractors,” he added. “We will continue to review the proposal and provide clear feedback to the department on how to address these concerns and ensure the continuation of the owner-operator model within the trucking industry. Small-business truckers and professional drivers are the backbone of the trucking industry and failing to listen to them would make any rule unworkable.” The comment period for the proposed rules closed on November 28. So, the question remains: Is employee misclassification a major issue in the trucking industry? “Trucking is under so much scrutiny, it would not be worth it,” Hopkins said. “We get challenged all the time.” Hopkins, who says 85% of Prime’s fleet is comprised of independent contractors, thinks it would be careless for a company to not comply with independent contractor rules. “When a driver enters (the Prime fleet), they can choose whether to lease or be a company driver,” he said. “With 85% being independent contractors, that should say something.” Independent contractors have the authority to make their own decisions and are good at finding ways to save money and make repairs without relying on the company, he noted. “Independent contractors outperform and make more money than company drivers,” Hopkins said. “These guys are good businessmen.” One of the biggest concerns in freight is that the new rulemaking could open the door to allowing legislation like California’s AB5 being applied across the nation. California’s AB5 expanded on a ruling made in a case that reached the California Supreme Court in 2018, Dynamex Operations West, Inc., vs. Superior Court of Los Angeles. AB5 put in place a three-pronged test when determining whether workers are independent contractors or company employees. AB5 was originally designed to regulate companies that hire gig workers in large numbers, such as Uber, Lyft and DoorDash — but the test became the new “gold standard” requirement for all companies in the state. Hopkins says the most troublesome prong of the AB5 “test” is one that essentially states that an independent contractor can’t work in the same industry as the employer. AB5 requires companies to reclassify their contract drivers as employees, with the same protections and benefits as their other staffers. This entitles them to workers’ compensation, unemployment insurance, paid sick and family leave and health insurance, among other employee benefits. While this might be a plus for some drivers, others prefer to maintain the autonomy and flexibility afforded to independent contractors. There are some contractors who are exempt from AB5. There are exemptions for doctors, dentists, insurance agents, lawyers, accountants, securities brokers, real estate agents, hairstylists and many other professionals — but not for truck drivers. “We basically don’t have independent contractors in California (due to AB5),” Hopkins said. “We have independent contractors in California that would like to work for us but can’t.” If a rule like AB5 goes national, Hopkins says, he believes many drivers who are now functioning as independent contractors and owner-operators would move to other professions. “I think it would have a terrible impact on the already short supply of drivers,” he said. “If they can’t make the same money, they’ll move to something else. AB5 is a bad law.”