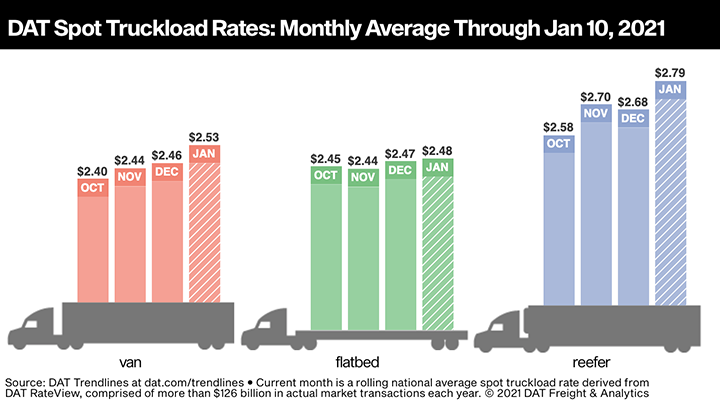

Sales of new Class 8 trucks and trailers are poised to end 2020 on a strong note, reflecting buyer confidence in a growing economy. For the past 20 years, U.S. sales of new Class 8 trucks have averaged close to 190,000 per year. At the end of November, sales were already over 174,000, according to data received from ACT Research (actresearch.net). Kenny Vieth, president and senior analyst for ACT, said he was expecting a “huge” December. “Carriers will be investing profits in new equipment to avoid paying taxes on them,” he said. ACT reported U.S. sales of 18,092 Class 8 trucks in November. Although that number was down 4.9% from October sales and down 4.2% from November 2019 sales, it was still the fourth-best November in the past two decades. Of the Class 8 trucks sold, 13,711 (75.8%) were fifth-wheel equipped road tractors while 24.3% were destined for vocational uses such as dump, concrete and trash hauling. Those percentages are much closer to historic 3:1 road versus vocational numbers. During the second quarter of 2020, vocational tractors represented more sales, reaching 45.4% of Class 8 trucks sold on the U.S. market in May. While truck sales were strong, orders for more new trucks were approaching record-setting territory. “North American orders for Class 8 trucks were 52,104 in November,” Vieth said. “That’s the third-best in history.” Industry analysts at FTR (www.ftrintel.com) reported orders of 52,600 new trailers in a Dec. 2 release. “The huge November orders mean that Q4 will be a fabulous one, regardless of what comes in for December and that portends well for the expected increase in production early next year,” explained Don Ake, vice president of commercial vehicles at FTR. The increased orders are all about locking in build slots. Truck manufacturers typically build about 27,000 trucks per month, so it will take nearly two months to build the trucks ordered in November alone. According to Vieth, the backlog of trucks ordered but not yet built stood at 148,000 at the end of November. That’s a waiting list of five-and-a-half months, and it’s growing. “If you want a new Class 8 truck in 2021 but haven’t made the decision, I would recommend not waiting,” Vieth said. “The backlog isn’t getting smaller.” Money is driving the demand for new trucks. “Fleets are still trying to catch up with the jump in freight volumes resulting from the economic restart and the generous stimulus money which is being spent predominately on consumer goods and food,” Ake asserted. That jump in freight volumes has been accompanied by rising spot rates. How far have they risen? “We’ve had four months of record spot rates,” Vieth said. “Spot rates are up 47% year over year.” DAT Services (www.dat.com) reported national average spot rates of $2.45 per mile for dry van freight in November, 63 cents per mile higher than November 2019. Refrigerated rates were even better at $2.69 per mile, 51 cents higher than a year ago. Flatbed rates averaged $2.44 per mile, an increase of 34 cents over November 2019 rates. While rising spot rates are good news for truckers who get their loads from brokers, those who depend on contract rates for their revenue must wait a little longer to reap the benefits. “Contract rates typically lag behind spot rates by four or five months and are rising as we go into the new year,” Vieth noted. “If contract rates rise at just half the rate of spot rates, they’ll increase well over 20% in 2021.” Vieth said shippers are wary of getting locked in to contracts that could keep rates high when the market cycles downward. “A new term has been added to our vocabulary — the ‘mini-bid.’ Shippers have been offering higher contract rates to nail down capacity, but for a shorter contract period so they can avoid being locked in when rates fall again,” he explained. One industry problem that actually helps drive rates skyward is the shortage of available drivers. Claims of a driver shortage have been met with skepticism in the past, but several factors have combined to eliminate needed drivers from the available pool. One factor is the dearth of new drivers graduating from CDL schools that have restricted enrollment or have shut down entirely. Older drivers, on the other hand, are retiring rather than work with ELDs, in-cab video cameras and other industry changes that many feel are oppressive. The Federal Motor Carrier Safety Administration’s (FMCSA) Drug and Alcohol Clearinghouse is another factor, as the percentage of drivers that are tested annually has doubled to 50% and drivers with positive results choose to leave the industry rather than participate in return-to-work programs. The job market itself is a factor as the shift to mail order of goods creates more local delivery jobs that allow drivers to be home daily. As for truck sales in November, Daimler-owned companies were the only OEMs to increase sales over October numbers, according to data received from Wards Intelligence (wardsintelligence.com). Freightliner led the way with sales of 7,709, up 5.1% over 7,332 sold in October. November numbers even bested November 2019 sales of 7,673 by 0.5%. Western Star’s sales volume was only about 6.4% of Freightliner’s, but the 492 trucks sold in November topped October’s 484 by 1.7% and last November’s 471 by 4.5%. Peterbilt’s 2,679 units sold in November was only 20 trucks shy of the October mark, a decline of 0.7%. Compared to November 2019 sales of 3,444, deliveries declined by 22.2%. Kenworth reported sales of 2,588 for November, a decline of 9.5% from the 2,859 sold in October and 22.3% lower than the 3,332 sold in November a year ago. Newly acquired Traton OEM Navistar reported sales of 1,847 Class 8 International units, down 22.3% from 2,377 the previous month and 59.9% lower than November 2019 sales of 4,602 units. Volvo sales of 1,430 were 22.3% lower than October sales of 1,943 and down 36.4% from November 2019 sales of 2,248. Sibling Mack sold 1,057 in the month, down 1.9% from 1,077 in October and 13.6% fewer than the 1,224 sold in November a year earlier. On a year-to-date basis, truck sales are running 32.7% behind last year’s near-record pace. Freightliner still rules, capturing 37.9% of Class 8 truck sales. Peterbilt (15.2%) and Kenworth (14.6%) claim 29.8% of 2020 sales while Mack (7.2%) and Volvo (9.7%) make up another 16.9% of the market. International claims 12.3%, down 2% from last year’s market share, while Western Star gets 2.9%. Tiny Hino’s sales of 24 don’t move the meter, but sales are triple last year’s eight for the first 11 months of 2020. Tightened capacity means rising rates and truck buyers want power units to take advantage. “I’m predicting record trucking industry profits in 2021,” asserted Vieth. He’s not the only one.