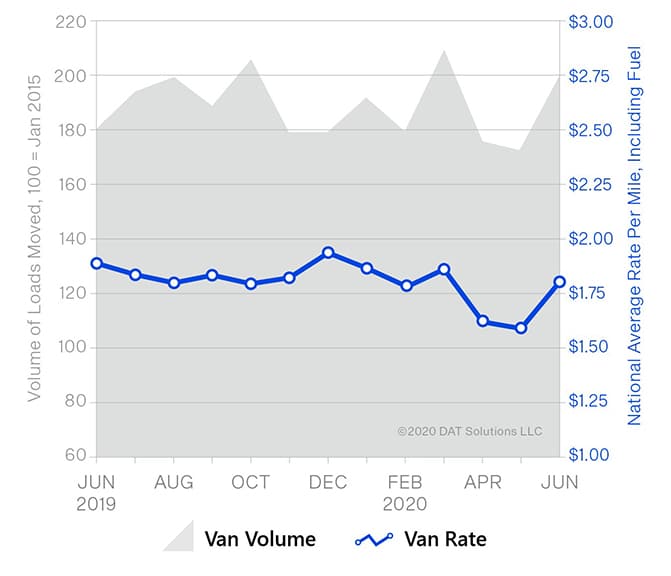

COLUMBUS, Ind. — As the COVID-19 pandemic continues to have a negative impact on the global economy, reports from ACT Research (ACT) for June show continued rebounds in the North American trucking industry after shutdowns in March, a “dismal” April and slight improvements in May. FOR-HIRE TRUCKING INDEX The latest release of ACT Research’s For-Hire Trucking Index, which includes data for June, shows continued, significant improvement in the diffusion index measures tracked. The volume index rose to 70.4 in June, up from 19.3 in April and 50.2 in May, with pricing and productivity at 65.2 and 69.9, respectively. Capacity remained stuck in neutral, hovering near the 50 mark. “The survey confirmed much of what we witnessed in rate data over the course of June, as the supply-demand balance tipped in truckers’ favor as the economy reopened,” said Kenny Vieth president and senior analyst for ACT Research. “While encouraging, we would note some transitory risks, one being the economic strength in May and June was heavily subsidized by Congress and the Federal Reserve.” ACT’s For-Hire Trucking Index is a monthly survey of for-hire trucking service providers. Responses are converted into diffusion indexes, where the neutral or flat activity level is 50. Vieth also credited June’s strong rates to parked trucks and laid-off driver capacity. “The strong rebound in freight volumes from April’s trough underscores the rapid move in freight rates, as the market moved from too little to too much freight relative to available capacity,” Vieth noted, regarding the uptick in freight rates. “The path on rates from here will be largely determined by the economy’s ability to hold the line on freight volumes.” When asked about the overall picture, Vieth explained, “Shrinking Class 8 retail sales suggest equipment capacity will continue to tighten, but with sidelined drivers likely returning and lenders extending loans, it may be a while before the market tightens structurally. The road back might be a long one.” The ACT Freight Forecast provides forecasts for the direction of truck volumes and contract rates quarterly through 2020 with three years of annual forecasts for the truckload, less-than-truckload and intermodal segments of the transportation industry. For the truckload spot market, the report provides forecasts for the next 12 months. In 2019, the average accuracy of the report’s truckload spot rate forecasts was 98%. The ACT Research Freight Forecast uses equipment capacity modeling and the firm’s economics expertise to provide unprecedented visibility for the future of freight rates, helping businesses in transportation and logistics management plan for the future with confidence. NORTH AMERICAN CLASSES 5-8 REPORT Also showing improvement with a return to “something closer to life as usual,” ACT’s State of the Industry: NA Classes 5-8 report shows “surprisingly strong” growth in the commercial vehicle market. ACT’s State of the Industry: NA Classes 5-8 report provides a monthly look at the current production, sales and general state of the on-road heavy- and medium-duty commercial vehicle markets in North America. The report differentiates market indicators by Class 5, Classes 6-7 chassis and Class 8 trucks and tractors, detailing measures such as backlog, build, inventory, new orders, cancellations, net orders and retail sales. Additionally, Class 5 and Classes 6-7 are segmented by trucks, buses, RVs and step van configurations, while Class 8 is segmented by trucks and tractors with and without sleeper cabs. This report includes a six-month industry build plan, backlog timing analysis, historical data from 1996 to the present in spreadsheet format, and a ready-to-use graph package. A first-look at preliminary net orders is also published in conjunction with the report. “A survey of the current business landscape shows a picture of intensifying cross-currents, with an uncertain outcome,” Vieth said. “On one side, the economy and motor freight have been surprisingly strong from the beginning of May to mid-July, resulting from dialed back restrictions on workplaces, relaxed shelter-in-place (orders) and the associated revival in business and social activity,” he said. “However, closely associated with return-to-normal has been its downside, the rise of COVID-19 cases.” Vieth noted that the most severe impact of the current recession has been on service sectors, unlike previous downcycles. While important to the economy, service sectors do not rely on truck transportation as heavily as other industries, he said. “The revival of the economy and freight is readily apparent in the sharp increase in Class 8 net orders in June, with upgrades in production, as well,” Vieth said. “Classes 5-7 orders continued their rebound in June, marking the best sequential gain since August 2009.” U.S. CLASSES 3-8 USED TRUCKS ACT’s latest release of its State of the Industry: U.S. Classes 3-8 Used Trucks shows that used Class 8 same-dealer sales volumes were up 6% year to date against the first half of 2019, with average price, miles and age all below June 2019 year-to-date rates, down 15%, 2%, and 7%, respectively. Near term, the report indicated that used Class 8 sales volumes rose 50% sequentially, with average price down 1% month over month, average miles up 1% month over month and average age flat compared to May. The report provides data on the average selling price, miles and age of used Class 8 trucks based on a sample of industry data. In addition, the report provides the average selling price for top-selling Class 8 models for each of the major truck OEMs — Freightliner (Daimler); Kenworth and Peterbilt (Paccar); International (Navistar); and Volvo and Mack (Volvo). “Despite the numbers above, some dealers reported that used truck sales have slowed and continue to be at a lower level than last year and pre-COVID-19,” said Steve Tam, vice president of ACT. “Used trucks were oversupplied before and have been since late 2019. That said, and not surprisingly, some dealers are reporting stronger sales and better customer interest in the last 30 days, while another contingent of dealers is reporting very slow market conditions,” Tam continued. “Stories have surfaced that some trucks selling at auction are bringing better prices than expected, but auctions can be deceptive, as prices via this channel can be higher or lower than expected, depending on who attends any given sale.” U.S. TRAILER REPORT June’s net U.S. trailer orders of 13,441 units were a dramatic improvement (333%) from May’s very low comparison, and were dramatically above June 2019’s level, up 112%. Before accounting for cancellations, new orders of 16k units were up 117% versus May and 41% better year over year, according to the latest issue of ACT’ State of the Industry: U.S. Trailer Report. The report provides a monthly review of the current U.S. trailer market statistics as well as trailer OEM build plans and market indicators divided by all major trailer types, including backlogs, build, inventory, new orders, cancellations, net orders and factory shipments. “It is important to remember that those comparisons are to exceedingly low orders during the first part of this quarter, when widespread COVID lockdowns were in place,” said Frank Maly, director of commercial vehicle transportation analysis and research for ACT. “That said, the improved sequential comparisons do indicate some fleets, after assessing current market conditions, are beginning to cautiously commit to capital expenditures.” According to Maly, June’s improvements were driven by large fleet orders, indicating that improvement is not spread evenly across all OEMs. “We expect that choppiness to continue as we move through the summer.” he commented, “OEMs continue to seek order/build equilibrium, and while some fleets are willing to make investment commitments, most continue to remain on the sidelines, despite some negotiations occurring to help generate order volume.”