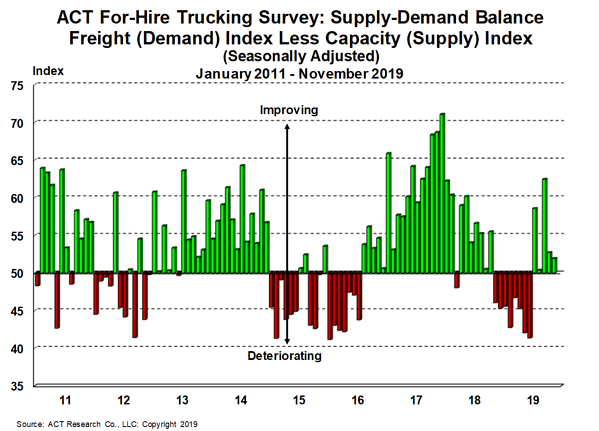

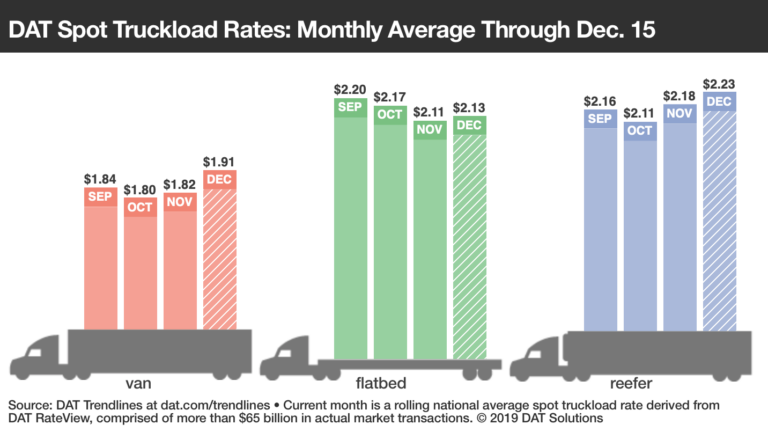

COLUMBUS, Ind. — According to ACT’s latest release of the North American Commercial Vehicle OUTLOOK, expectations for the Class 8 and trailer production volumes have been trimmed for 2020, and expectations of a recovery starting in 2021 have been tempered. Meanwhile, ACT’s December installment of the ACT Freight Forecast, U.S. Rate and Volume OUTLOOK report covering the truckload, intermodal, LTL and last mile sectors came with this headline: “Freight forecast: Lowering truckload spot rate forecasts on freight demand; what could drive rates up in 2020?” As for the tempered Class 8 outlook, ACT President and Senior Analyst Kenny Vieth pointed to three factors. “Broadly, there are three components to the forecast cuts for 2020 and 2021: Supply, demand, and timing,” Vieth said. “Some, like overcapacity, have been on the radar for a long time. Others, like the growing weakness in manufacturing and the broader economy, have come on slowly and inexorably over several months. The past six months have been marked by a continued loss of traction in manufacturing. Despite the GM-impacted payroll increase in November, most recent evidence from the sector suggests that recovery is likely to come later, rather than sooner.” The North American Commercial Vehicle OUTLOOK is a robust report that forecasts the future of the industry, looking at the next 1-5 years, with the objective of giving OEMs, Tier 1 and Tier 2 suppliers, and investment firms the information needed to plan accordingly for what is to come. The report provides a complete overview of the North American markets, as well as takes a deep dive into relevant, current market activity to highlight orders, production, and backlogs, shedding light on the forecast. Information included in this report covers forecasts and current market conditions for medium and heavy-duty trucks/tractors, and trailers, the macroeconomies of the US, Canada, and Mexico, publicly-traded carrier information, oil and fuel price impacts, freight and intermodal considerations, and regulatory environment impacts. As for the freight forecast, Tim Denoyer, ACT Research’s vice president and senior analyst, said, “This is the largest year-over-year drop in container imports since the Great Recession, aside from holiday timing. While partly because of the comparison against pre-tariff inventory building last year, we see evidence that trade issues will continue to drag the freight cycle through the mud. We’ve been forecasting a lengthy freight recession, but October imports, down 8% year-over-year, and fourth quarter rail volumes, down 7% year-over-year, are missing low expectations. In addition to a turn for the worse in our Spot Leading Indicator, this led us to modestly lower our spot rate forecasts for the first half of 2020.” ACT Research also lowered Class 8 tractor sales forecasts today, supporting the beginning of the bottoming process for truckload rates, and this month’s report provides analysis of the factors that could pull forward the eventual rate recovery, from both a spot and a contract perspective. “We expect capacity to rebalance over the course of 2020, but we caution not to jump to the conclusion that capacity is tightening because of carrier failures,” Denover said. “While our thoughts go out to the affected employees, even the largest bankruptcy in truckload history this week accounts for just 0.2% of the active fleet, or about 3% of the Class 8 tractor capacity that was added over the past year, and the equipment will be remarketed.”