Business

Schneider now offers rail dray intermodal service

GREEN BAY, Wis. — Schneider, a provider of trucking, intermodal and logistics services, has added a new service to its lineup of intermodal solutions. Schneider Rail Dray focuses on the initial and end moves of intermodal transportation, getting freight from shipper to ramp and ramp to receiver — safely and seamlessly. “Expanding our strength of intermodal expertise to include Rail Dray ensures that we’re continuing to meet the demands of a changing industry,” said Jim Filter, Schneider’s senior vice president and general manager of intermodal. “The new service provides capacity and control to reliably move dray freight without the inconveniences typically associated with rail moves.” Schneider Rail Dray is optimal for: Railroad providers needing to move shipper freight. Third-party logistics providers lacking driver capacity. Direct shippers using their own intermodal containers. Filter said with one call, Schneider provides premium support and visibility needed for rail dray freight: Scale: Conducting over 1 million drays a year, Schneider has the scale to expertly dray freight across an entire network. Visibility: Satellite-tracking technology enables real-time visibility of dray freight and early notification of delays. Risk Mitigation: Schneider’s professionally trained, uniformed drivers operate newer company equipment that is maintained to the highest standard to safeguard against delays and minimize safety and regulatory exposure. Optimization: Schneider has the resources and know-how to efficiently optimize an entire dray network. To learn more about how Schneider Rail Dray avoids costly hang-ups and keeps rail freight moving, visit Schneider.com. Schneider’s services include regional and long-haul truckload, expedited, dedicated, bulk, intermodal, brokerage, warehousing, supply chain management and port logistics.

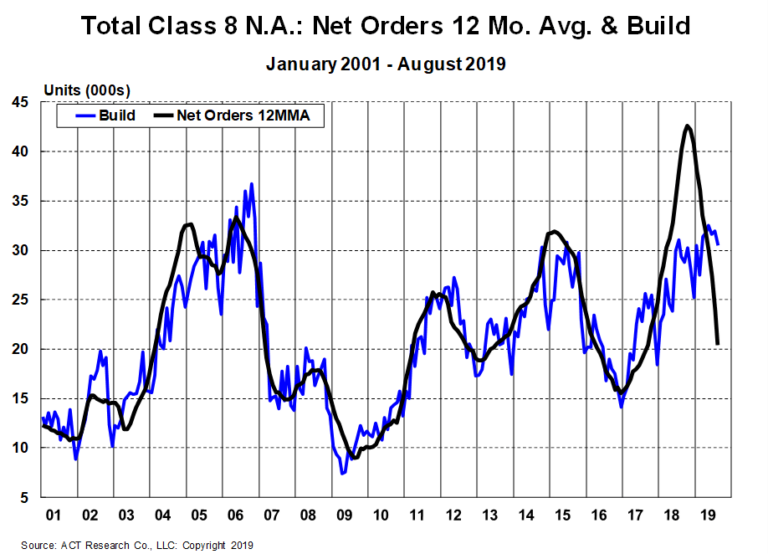

ACT Research says freight markets still weak, data still trending negative

COLUMBUS, Ind. — According to ACT Research’s (ACT) latest State of the Industry: Classes 5-8 Report, economic reports over the past month have more often risen above consensus than fallen below it, but it is premature to declare an end to freight market weakness. “Data points indicating increased economic activity represent the essential first steps in the process of increasing demand to rebalance the heavy freight markets. However, as in any commodity market, it is not just demand, but supply, and until the supply-side of the market is addressed, the disequilibrium story will continue to weigh on freight rates and by extension the heavy vehicle industry,” said Kenny Vieth, ACT Research president and senior analyst. “While the data are starting to suggest ‘less bad,’ reports suggesting recovery are premature, as key freight metrics continues to trend negative in the latest round of data releases.” Speaking about the Class 8 market, Vieth said that in concert with weak/deteriorating freight volumes and rates, forward-looking demand indicators continue to erode, even as mid and downstream data points remain robust. “Ultimately, the current situation of weak orders and strong build is unsustainable,” he said. Regarding the medium duty markets, Vieth said medium-duty demand metrics remain in better balance, but there are signs of modest fraying on weak net orders, relative build strength and excessive inventories.

Navistar to build new Class 6-8 manufacturing plant in San Antonio area

LISLE, Ill. — Navistar, a maker of commercial trucks and buses, said Thursday it will be making a capital investment of more than $250 million to build a new manufacturing facility in Texas. The investment, which is contingent on finalization of various incentive packages, will bring approximately 600 jobs to the San Antonio area. “Over the last five years, Navistar has made significant investments to improve our position in the market,” said Troy Clarke, Navistar chairman, president and chief executive officer. “This investment will create a benchmark assembly facility to improve quality, lower costs and provide capacity to support anticipated industry growth, as well as market share gains.” The new manufacturing plant will have the flexibility to build Class 6-8 vehicles, complementing Navistar’s existing assembly manufacturing footprint, which includes truck assembly plants in Springfield, Ohio, and Escobedo, Mexico. Navistar’s trucks are manufactured under the brand name International. The announcement of the new Texas plant was part of Navistar’s Investor Day, where company executives presented their 2020-24 strategy “Navistar 4.0” that includes a plan to increase its EBITA margins to 12%. Clarke said “Navistar 4.0” includes the following elements: Improve EBITDA margins to 10% by 2022 and 12% by 2024. Grow market share and become the number one choice of the customer through new product offerings and customer segmentation. Implement a single platform strategy to optimize use of R&D resources and commonization of parts and tooling. Increase modular design resulting in customer benefits, speed to market and lower product costs. Build a new truck assembly facility in San Antonio, Texas, reducing logistics and manufacturing costs. Use the TRATON alliance to provide significant procurement savings, more efficient research and development spend and new integrated power train offerings for customers. Grow aftersales revenues with an expanding distribution network, growing private label sales and e-commerce initiatives. Improve financial results allowing the company to invest in growth initiatives, de-lever the balance sheet and fully fund its defined benefit pension plans by 2025. Building on the major advances achieved in the last five years, including gains from an alliance with TRATON Group, Navistar 4.0 lays out a clear path for the company’s ongoing transformation, Clarke said. “Navistar is committed to building on the gains of the past five years to improve financial returns to shareholders,” he said. “Navistar 4.0 establishes a clear road map to grow EBITDA margins to 12%, while also winning in the marketplace.” The new Texas investment builds on Navistar’s recently announced plans to invest $125 million in the Huntsville, Alabama, engine plant to produce next-generation, big-bore powertrains developed as part of the alliance with TRATON, a subsidiary of Volkswagen AG and a global commercial vehicle manufacturer worldwide. The Texas site is located on a critical corridor along Interstate 35, which links Navistar’s southern United States and Mexico supply bases, allowing for significant logistic improvements, resulting in lower cost and enhanced profitability. “This investment by Navistar is paramount to Texas’ success in growing our diverse and highly skilled manufacturing workforce,” said Texas Gov. Greg Abbott. “The Lone Star State is the new frontier in innovation, and I am confident that this partnership will usher in even greater economic prosperity for our state.” “We are so proud to have a company like Navistar, a leader in vehicle innovation, in San Antonio,” said San Antonio Mayor Ron Nirenberg. “It shows that our strategy to grow our advanced manufacturing sector is working.” “The county has, for many years, been touting the strength of our Texas-Mexico region as a platform for vehicle production,” said Judge Nelson Wolff. “Navistar’s decision to locate their newest facility here is just the latest affirmation that our community is uniquely situated to host world-class companies in advanced manufacturing industries. We are thrilled to have them in Bexar County.” Navistar plans to break ground on the property later this year and anticipates production to begin approximately 24 months later. In its presentation Thursday, Navistar also provided industry and company financial guidance for 2020, including: Industry retail deliveries of Class 6-8 trucks and buses in the United States and Canada are forecast to be between 335,000 and 365,000 units. Revenues are expected to be between $10.0 billion and $10.5 billion. Adjusted EBITDA is expected to be $775 million to $825 million. Manufacturing free cash flow is expected to be break-even excluding changes in working capital. For more information, visit www.navistar.com.

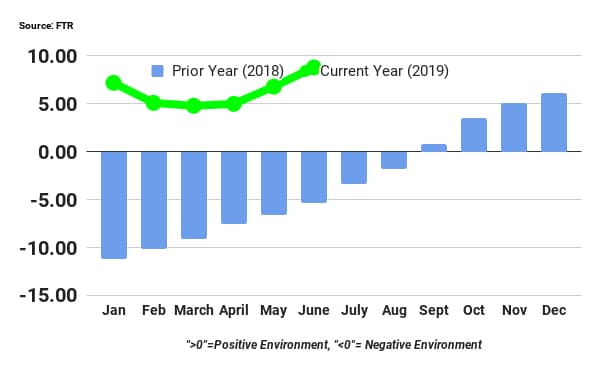

FTR Trucking Conditions Index for July improved to reading above neutral

BLOOMINGTON, Ind. — FTR’s Trucking Conditions Index for July improved slightly to a just above neutral reading of 0.28. Lower diesel prices offset the effects of lower capacity utilization pushing the reading into positive territory for the first time since January. Although some positive readings are possible over the next year, the outlook is for primarily negative to neutral readings throughout the time frame. Details of the TCI for July are found in the September t issue of FTR’s Trucking Update, published August 30. The “Notes by the Dashboard Light” section issues readers a warning about the possibility for slower growth ahead. Along with the TCI and “Notes by the Dashboard Light,” the Trucking Update includes data and analysis on load volumes, the capacity environment, rates, costs, and the truck driver situation. “Although it has become common to hear dire warnings about the state of the trucking industry, the truck freight market as a whole is hardly collapsing,” said Avery Vise, vice president of trucking. “Rapid cooling from last year’s extraordinarily strong market certainly has left many weak carriers exposed, but freight volume and rates are holding up reasonably well – certainly if viewed in a longer-term context. Still, most of the near-term risks to our outlook are on the downside.” The TCI tracks the changes representing five major conditions in the U.S. truck market, including freight volumes, freight rates, fleet capacity, fuel price and financing. The individual metrics are combined into a single index indicating the industry’s overall health. A positive score represents good, optimistic conditions. Conversely, a negative score represents bad, pessimistic conditions. Readings near zero are consistent with a neutral operating environment, and double-digit readings (up or down) suggest significant operating changes are likely. In addition to the monthly updates on trucking conditions, FTR offers a weekly Trucking Market Update in the State of Freight Podcast. The weekly update, hosted by Avery Vise, covers spot market and economic indicators and major industry developments. To listen to recent episodes and download the indicators that are covered, go to www.FTRintel.com/podcast. To learn more about FTR visit www.FTRintel.com or call 888-988-1699 or email or email [email protected].

Average on-highway gallon of diesel up 1.6 cents, but crude oil up 12.97%

WASHINGTON — The average on-highway price of a gallon of diesel rose 1.6 cents a gallon to $2.987 for the week ending September 16, according to the Energy Information Administration of the Department of Energy. It was the first weekly increase since the week ending July 8 when the price went up 1.3 cents a gallon to $3.055. What, if any, impact did the attack on the Saudi oil facility have on the price this week is hard to determine since the attack occurred only early last Saturday. “Our team is keeping a close eye on the impact of the Saudi oil fire on the diesel market,” said a spokesperson for Pilot Flying J. “We have already seen the market react, but it’s too early to predict the extent of the impact. Our No. 1 priority remains getting our guests from point A to point B as quickly and conveniently as possible.” The price of West Texas Intermediate crude rose 12.97% to $61.93 Monday. All regions of the country increased with the exception of the Central Atlantic States (New York, Pennsylvania, Maryland, Delaware and New Jersey) where the price dropped nine tenths of a penny to $3.013. The largest increase was in the West Coast minus California at 3 cents top $3.161. The next largest increase was 2.6 cents in the overall West Coast region (California, Arizona, Nevada, Oregon and Washington) and the Rocky Mountain states (Colorado, Utah, Wyoming, Idaho and Montana. The price for the week ending September 16 was 28.1 cents lower than the comparable week in 2018. For a complete list of prices by region for the past three weeks, click here.

July marks all-time high for DOT’s freight transportation index

WASHINGTON — The Department of Transportation’s Bureau of Transportation Statistics’ (BTS) said Thursday that the Freight Transportation Services Index (TSI), which is based on the amount of freight carried by the for-hire transportation industry, rose 0.9% in July from June, rising to a new all-time high after declining for two consecutive months. From July 2018 to July 2019, the index rose 2.9% compared to a rise of 6.0% from July 2017 to July 2018. The Freight TSI measures the month-to-month changes in for-hire freight shipments by mode of transportation in tons and ton-miles, which are combined into one index. The index measures the output of the for-hire freight transportation industry and consists of data from for-hire trucking, rail, inland waterways, pipelines and air freight. The TSI is seasonally-adjusted to remove regular seasons from month-to-month comparisons. The BTS said the Uly increase was broad based with increases in rail carloads, rail intermodal, trucking, pipeline and air freight. There was a small decline in water transportation. The TSI increase took place against a background of mixed results for other indicators. The Federal Reserve Board Industrial Production Index declined in July, reflecting decreases in mining and manufacturing and an increase in utilities. Personal income increased by 0.1%, while housing starts declined by 4.0%. The Institute for Supply Management Manufacturing index decreased 0.5 points to 51.2, indicating continued but slowing growth. The BTS said despite small decreases in both May (-0.1%) and June (-0.3%), the July index was 0.6% over its April level and 0.2% over its previous record high in November 2018. The record high level was reached even though the index increased in only four of the eight months since November. From a low point in March 2016, the index climbed 12.8% until reaching a new high in May 2018. From that point, the index has exceeded its levels in all months prior to May 2018. The July 2019 index was 46.6% above the April 2009 low during the most recent recession. For-hire freight shipments in July 2019 (139.0) were 46.6% higher than the low in April 2009 during the recession (94.8). The July 2019 level reached its all-time high. For-hire freight shipments measured by the index were up 2.1% in July compared to the end of 2018. For-hire freight shipments are up 15.4% in the five years from July 2014 and are up 41.4% in the 10 years from July 2009.

Class 8 sales up in August, but figures indicate forecast slowdown coming

SOUTHFIELD, Mich. — It appears that the much-discussed prospective chink in the armor of a two-year upward trend of new Class 8 truck sales is now visible. Wards Intelligence reported Wednesday that August sales of 23,466 was a 6.7% decline from July’s sales of 25,164, but perhaps more significantly, it marked the first time in the past 25 months that sales had not exceed the figure for the comparable month in the previous year. The streak began in July 2017 when sales were 8.7% higher than July 2016. July sales in 2019 were 21.9% higher than sales in July 2018. Still in place is a streak of 20 consecutive months where the year-to-date sales has been higher than the same period the previous year, although that percentage has declined in each of the past three months. Year-to-date sales of 183,462 in 2019 are up 18.7% over the same period in 2018 when sales had totaled 154,587. Only two OEMs posted month-over-month gains in August. Volvo sales of 2,563 were 3.1% higher in August when 2,486 units were sold. Cousin Mack Trucks posted a 3% gain over July with sales of 1,773 in 2019 compared to 1,722 in July. The largest month-over-month decline was 15.1% at Freightliner, although the Daimler Trucks North America product continues to hold the top position in market share at 35.6% with sales of 66,937. The next closest OEM is Peterbilt at 15.1% As would be expected with year-to-date sales comparisons, all OEMs are ahead of 2018. International leads the parade at 28.9% (sales of 26,635 versus 20,663) followed by cousins Kenworth (21.2%) and Peterbilt (20.3%)

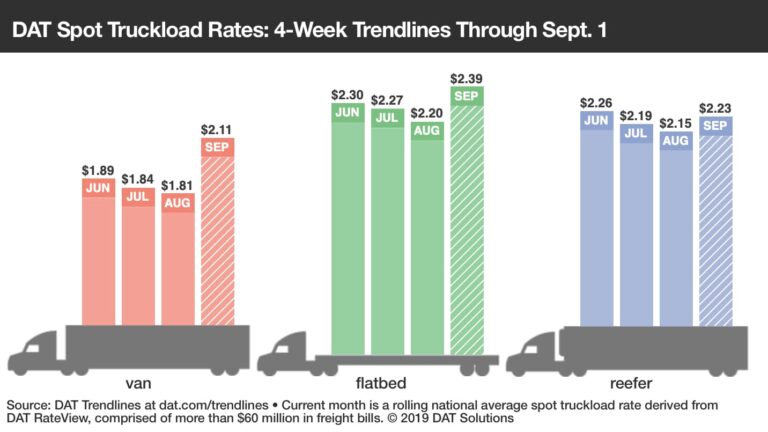

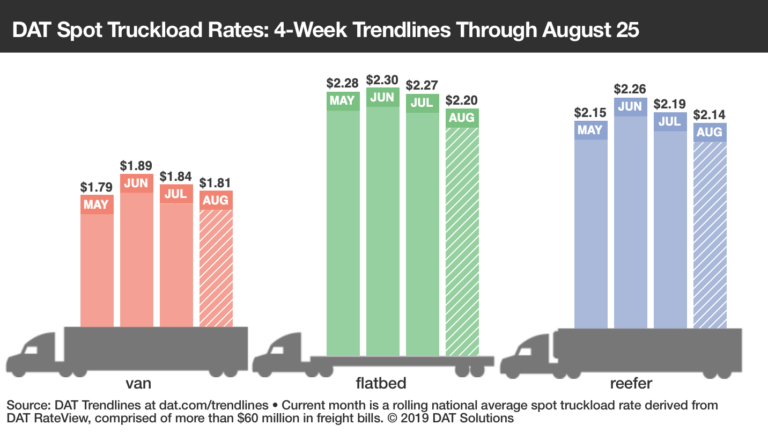

DAT Solutions reports spot van rates tick up, reversing declines

PORTLAND, Ore. — A strong close to the month of August continued into September as spot truckload rates increased during the week ending September 8, said DAT Solutions, which operates the industry’s largest network of load boards. The number of posted van, refrigerated, and flatbed loads from September 2-8, which included Labor Day, fell 7% compared to the previous week while the number of available trucks declined 12%. Declines of 20% are more typical for a shorter workweek. Hurricane Dorian altered supply chains, with rates and volumes rising on many lanes into and out of coastal areas. Because the worst of the storm missed heavily populated areas in the United States, the effects on transportation thankfully were not as severe as originally forecast. National Average Spot Rates, September 2019 (through September 8): Van: $1.88 per mile, 7 cents higher than the August average Flatbed: $2.21 per mile, 1 cent higher than August Reefer: $2.19 per mile, 5 cents higher than August Van trends Van load counts and load-to-truck ratios have steadily increased over the past few weeks. Rates tend to rise when the load-to-truck ratio exceeds 2.5, and the ratio peaked at 3.5 last week before settling to an average of 2.7. Indeed, the spot van rate is currently equal to February 2018 levels after nearly seven month of declines, and rates on 68 of DAT’s Top 100 biggest van lanes by volume were higher compared to the previous week. Atlanta ($2.16 per mile, up 5 cents), Charlotte, North Carolina ($2.10 per mile, up 6 cents), and Philadelphia ($1.83 per mile, up 6 cents) paced rising markets as shippers moved goods ahead of the weather last week. Generally, rates increased on lanes moving toward the path of the storm: Charlotte, North Carolina, to Lakeland, Florida: $2.37 per mile, up 19 cents Allentown, Pennsylvania, to Richmond, Virginia: $2.58 per mile, up 15 cents Philadelphia to Charlotte, North Carolina: $1.68 per mile, up 15 cents Reefer trends The national reefer load-to-truck ratio averaged 5.0 last week, a half-point better than the August average. California and Michigan harvests joined with supply chain shifts to boost demand for reefers. Leading markets: Grand Rapids, Michigan: $3.66 per mile, up 26 cents Sacramento, California: $2.76 per mile, up 6 cents Atlanta: $2.60 per mile, up 10 cents Elizabeth, New Jersey: $1.94 per mile, up 7 cents Other markets saw higher levels of freight for a holiday-shortened week, including Chicago; McAllen, Texas; and Stockton, California, part of the Sacramento market. Elizabeth, New Jersey, to Boston saw the average rate rise 42 cents to $4.36 per mile as the possibility of Dorian hitting New England late in the week fueled demand. Key takeaways Spot reefer rates are up by at least 1% in two consecutive weeks. Western Michigan is in apple season, with rates and volumes rising. Hot ZIP codes for freight: 490XX and 491XX (Kalamazoo, Battle Creek); 494XX (Muskegon); and 492XX (Jackson). It bears repeating that if you have resources to offer during hurricane recovery efforts, consider the American Logistics Aid Network. DAT Trendlines is a weekly snapshot of month-to-date national average rates from DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $65 billion in annualized freight payments. DAT load boards average 1.2 million load searches per business day. For the latest spot market loads and rate information, visit dat.com/trendlines and follow @LoadBoards on Twitter.

Price of gallon of on-highway diesel declines one-half a penny

WASHINGTON — The average on-highway price of a gallon of diesel declined half a cent to $2.971 for the week ending September 9, according to the Energy Information Administration of the Department of Energy. It marked the ninth consecutive week the price has declined, according to EIA data. The largest decline was 1.7 cents in the Central Atlantic states (New York, Pennsylvania, Maryland, Delaware and New Jersey) followed by a one cent a gallon drop in the Midwest (North Dakota, South Dakota, Nebraska, Kansas, Oklahoma, Missouri, Iowa, Minnesota, Wisconsin, Illinois, Tennessee, Kentucky, Ohio, Indiana and Michigan). Only the Rocky Mountain States (Colorado, Utah, Wyoming, Idaho and Montana) at nine-tenths of a cent and the Gulf Coast (New Mexico, Texas, Arkansas, Louisiana, Mississippi and Alabama) at half a cent posted an increase. The average price nationally is 27.7 cents a gallon lower than the comparable week last year. For complete prices by region for the past three weeks, click here.

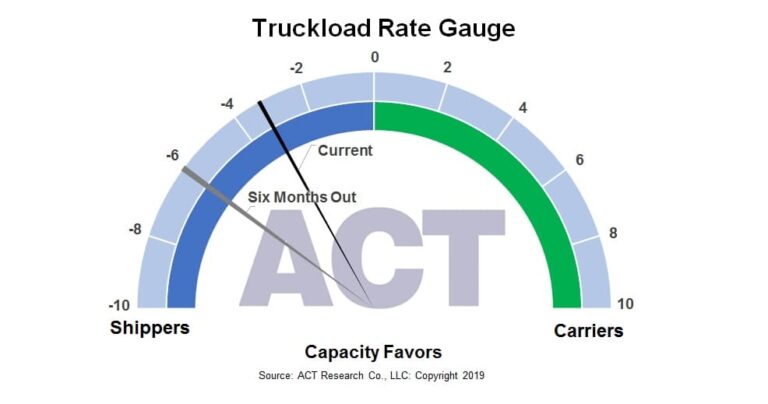

ACT Research freight forecast: Pre-ship provides respite from freight downturn

COLUMBUS, Ind. — Officials at ACT Research said Monday that for the past few months, ACT had been expecting pre-tariff shipping to ramp up ahead of the List 4 tariffs and this month’s OUTLOOK report presents a plethora of evidence that inventory building is the main factor behind the recent uptick in freight. The “ACT Freight Forecast, U.S. Rate and Volume OUTLOOK covers the truckload, intermodal, LTL and last mile sectors of the industry. With the temporary nature of this tailwind, ACT Research maintained its view that truckload and intermodal contract rates will fall this year as a result of overcapacity and weak freight demand, while LTL pricing will stay positive. “We now expect another soft patch in freight when the current inventory build turns to a draw, likely this winter after tariffs are imposed,” said Tim Denoyer, ACT Research’s vice president and senior analyst. “This is similar to the dynamic of last year, but the main difference is that capacity has loosened materially. Truck sales have not softened yet, and amid ongoing excess capacity, this will hurt truckers’ negotiating position just as discussions begin for next year’s bid season.” U.S. Class 8 tractor order intake was down about 90% year-over-year in July and August, off record levels a year ago, but OEMs still have not meaningfully lowered production rates and new truck inventories are at all-time highs. While backlogs are quickly thinning, carriers are still spending aggressively and adding to capacity. “We remain very concerned about a variety of adverse economic consequences of U.S. trade policy, from the inverted yield curve to the industrial downturn to lower confidence and elevated uncertainty, not just inventory swings,” Denover said. “While recession is still not our base case, risks are heightened.” The ACT Truckload Rate Gauge improved this month on better freight volume, though it still favors shippers with a -3 reading. The coming decline in U.S. Class 8 tractor build rates should begin to bring the supply side a little more into balance, but inventory distortions are expected to become a headwind for freight in early 2020, pushing the gauge back to -6, Denover said. The Truckload Rate Gauge is ACT’s measure of trucking industry supply/demand, balancing changes in the number of active trucks and the amount of available freight. “The current gauge gives us a good directional feel for spot today and contract in about six months, and the Six Months Out gauge tells us about spot in six months and contract in about a year,” Denover said. The ACT Freight Forecast provides quarterly forecasts for the direction of volumes and contract rates through 2020 and annual forecasts through 2021 for the truckload, less-than-truckload and intermodal segments of the transportation industry. For the truckload spot market, the report provides forecasts for the next 12 months. ACT Research is a publisher of commercial vehicle truck, trailer, and bus industry data, market analysis and forecasts for the North America and China markets. ACT’s analytical services are used by all major North American truck and trailer manufacturers and their suppliers, as well as banking and investment companies For more information, visit www.actresearch.net.

Holland celebrating 90 years of providing regional service

HOLLAND, Mich. — Holland, a subsidiary of YRC Worldwide Inc. and a provider of next-day delivery in the central and southeastern United States, is celebrating its 90-year anniversary. The company is acknowledging how far it has come since 1929, when John and Katherine Cooper began hauling grain and hay for farmers during the Great Depression under the company name Holland Motor Express. Today, Holland has grown to be a nationally recognized carrier, operating 53 service centers across the U.S. with more than 6,800 trailers and 4,100 tractors. Holland, a member of the YRC Worldwide family of brands, employs more than 8,200 team members. “John and Katherine Cooper started Holland Motor Express with a strong set of core values: having integrity in all relationships, showing respect for each individual, working hard, excelling in all areas of customer service and continuously improving,” said Scott Ware, chief network officer at YRC Worldwide and president of Holland. “These are the values our employees continue to live out today, carrying our founders’ vision forward over the course of 90 years. We are humbled to have come this far, and we know we have the right people with the right service commitments in place, positioning us to be a valuable resource for customers well into the future.” As part of Holland’s 90-year celebration, the company held events in its Holland, Michigan, office, as well as field offices, to recognize and thank the thousands of loyal employees who work hard to take care of the customers they serve. Holland is also celebrating recently being named a 2019 Quest for Quality award winner in the South/South Central Regional LTL Carriers category; the 2018 LTL Carrier of the Year by the True Value Company and the LTL Interregional Carrier of the Year by Ryder. These awards are among many other accolades earned by Holland for its on-time performance, claims handling, customer service, technology applications and economic value.

Navistar reports ‘another great’ third quarter with net income of $156 million

LISLE, Ill. — Navistar International Corp. Thursday said it had posted third quarter 2019 net income of $156 million, or $1.56 per diluted share, compared to third quarter 2018 net income of $170 million, or $1.71 per diluted share. Navistar manufactures International brand trucks. Third quarter 2019 adjusted earnings before interest, tax, depreciation and amortization (EBITDA) was $266 million, compared to $218 million in the same period one year ago. Adjusted net income in the quarter grew 55 percent to $147 million, compared to $95 million last year. Revenues in the quarter were $3 billion, up 17 percent from the same period one year ago, primarily due to a 28 percent increase in volumes in the company’s core market, which is Class 6-8 trucks and buses in the United States and Canada). “This was another great quarter for Navistar,” said Troy A. Clarke, Navistar chairman, president and chief executive officer. “Market share increased, revenues and earnings grew at double-digit rates, and we made significant investments in our operations and our Uptime promise.” Navistar ended third quarter 2019 with $1.16 billion in consolidated cash, cash equivalents and marketable securities. Manufacturing cash, cash equivalents and marketable securities were $1.11 billion at the end of the quarter. The company generated $250 million of manufacturing free cash flow during the quarter largely because of strong adjusted EBITDA and net working capital performance. Clarke said the company had a number of uptime-related highlights during its third quarter. Navistar’s warranty performance and service partnership agreement with Love’s and Speedco, initially announced in March, is now fully operational, activating the commercial vehicle industry’s largest service network in North America. Additionally, the company’s latest parts distribution center (PDC) opened late last month near Memphis to help cater to the growing demand for parts and quicker maintenance turnaround times. Complementing the new PDC are new enhancements to Navistar’s retail inventory management system, resulting in 50 percent lower emergency parts orders, further maximizing Uptime for the company’s customers. Also during the quarter, the company announced it would be making capital investments of approximately $125 million in new and expanded manufacturing facilities at its Huntsville, Ala. plant to produce next-generation big-bore powertrains developed with its global alliance partner TRATON. The company updated the following 2019 full-year industry and financial guidance: Industry retail deliveries of Class 6-8 trucks and buses in the United States and Canada are forecast to be 435,000 to 455,000 units, with Class 8 retail deliveries of 295,000 to 315,000 units. Gross margin is expected to be in the range of 17.75% and 18%. Core market share is forecast to be between 18.5% and 19%. The company reaffirmed the following 2019 full-year financial guidance: Navistar revenues are expected to be between $11.25 billion and $11.75 billion. The company’s adjusted EBITDA is expected to be between $875 million and $925 million. Additionally, the company forecasts the industry’s 2020 retail deliveries of Class 6-8 trucks and buses in the United States and Canada to be in the range of 335,000 to 365,000 units, with Class 8 retail deliveries between 210,000 and 240,000 units. “We are on course for a strong end to 2019, and we’re not standing still,” Clarke said. “The company is recapturing market share and is growing revenue, EBITDA and cash flow. We remain focused on setting ourselves up for long-term success.”

Before Dorian, strong demand lifts spot truckload rates

PORTLAND, Ore. — Demand for capacity lifted spot truckload freight volumes and rates to monthly highs in the last week of August, said DAT Solutions, which operates the industry’s largest network of load boards. The number of posted van, refrigerated, and flatbed loads from August 26 to Sept. 1 increased 7% compared to the previous week while available capacity dipped 2.4% heading into Labor Day weekend. National average spot rates, August 2019, include: Van: $1.81 per mile, 3 cents lower than the July average Flatbed: $2.20 per mile, 7 cents lower than July Reefer: $2.15 per mile, 5 cents lower than July The September rolling average reflects just one day of activity, Sunday, September 1, but shows how much higher spot rates are to start the month compared to August: Van: $2.11 per mile Flatbed: $2.39 per mile Reefer: $2.23 per mile Van Trends Van load-to-truck ratios were notably strong and hit 3.0 as a national average on Wednesday, August 28. Van rates tend to rise when the ratio exceeds 2.5, which is where the average settled for the week. Dorian’s effects on supply chains came late in the week and had little impact on national trendlines during the reporting period. Rates on 73 of DAT’s Top 100 biggest van lanes by volume were higher, 17 lanes declined, and 10 were neutral compared to the previous week. While every major market east of the Mississippi River reflected stronger volumes last week, Memphis stood out with a 15% gain in available loads and an average outbound rate of $2.15 per mile, up 4 cents. Reefer Trends The national reefer load-to-truck ratio rose from 4.4 to 4.8 last week on the strength of apples and other tree harvests in the Pacific Northwest and Upper Midwest. Load-to-truck ratios jumped sharply in the Pendleton market (Yakima, Washington) and hit 23 on Friday, August 30, while Spokane, Washington, which includes Wenatchee, topped 34. The numbers are more stark at the ZIP code level: 988XX — Wenatchee— had 544 loads posted and just five trucks, while 989XX —Yakima—had 851 loads posted and 56 available trucks. One indication of advance planning for Hurricane Dorian: Lakeland, Florida, outbound reefer volume was up 14% and the average outbound rate jumped 8 cents to $1.39 per mile. Lakeland to Atlanta increased 18 cents to an average of $1.38 per mile. Key takeaways Spot freight volumes and rates were strong prior to any storm-related disruptions. It’s true that national average spot van rates in August were less than they were in July, but they were higher than both April ($1.80 per mile) and May ($1.79 per mile). Diesel fuel is 12 to 16 cents a gallon less than it was back then (spot rates factor a fuel surcharge calculation into the overall rate). Lower fuel costs are good news, especially for smaller carriers. If you have logistics resources to offer during hurricane recovery efforts, consider the American Logistics Aid Network. ALAN is a volunteer non-profit organization with a web portal where freight brokers, warehouses, and truck fleets can post available resources and aid organizations can post their needs. alanaid.org DAT Trendlines is a weekly snapshot of month-to-date national average rates from DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $65 billion in annualized freight payments. DAT load boards average 1.2 million load searches per business day. For the latest spot market loads and rate information, visit dat.com/trendlines and follow @LoadBoards on Twitter.

ACT Research: Commercial vehicle markets heading for market correction in 2020

COLUMBUS, Ind. — The heavy truck and trailer markets, and increasingly the medium duty market, are heading for corrections in 2020, even as the slow growth U.S. economic outlook remains largely unchanged, aside from concerns about trade and tariffs. ACT Research noted in its release of its Commercial Vehicle Dealer Digest noted that the key driver of the near to mid-term outlook is the U.S. consumer, who remains well positioned to keep the economy out of the ditch, even as key freight-generating sectors of the economy take a pause. “Current Class 8 production strength continues to cause an upward drift in 2019 expectations that is nibbling away at 2020 potential, as this year’s additional inventory accumulation will ultimately be paid back in future production levels,” said Kenny Vieth, ACT’s president and senior analyst. “The forecast scenario that we have been calling for appears to be playing out on schedule in the second half of this year, and if build rates are maintained longer than expected, there might still be some upside in the 2019 production forecast.” Vieth said, however, that large new inventories and deteriorating freight and rate conditions suggest erring on the side of caution remains the right call. “When the change comes, it is likely to come fast, and we are encouraging our subscribers to be prepared for down weeks starting as early as Q4,” he said. ACT Research is a publisher of commercial vehicle truck, trailer, and bus industry data, market analysis and forecasts for the North America and China markets. ACT’s analytical services are used by all major North American truck and trailer manufacturers and their suppliers, as well as banking and investment companies. More information can be found at www.actresearch.net.

The Trucker Newspaper – September 1, 2019 Digital Edition

Click here for more issues of The Trucker Newspaper online.

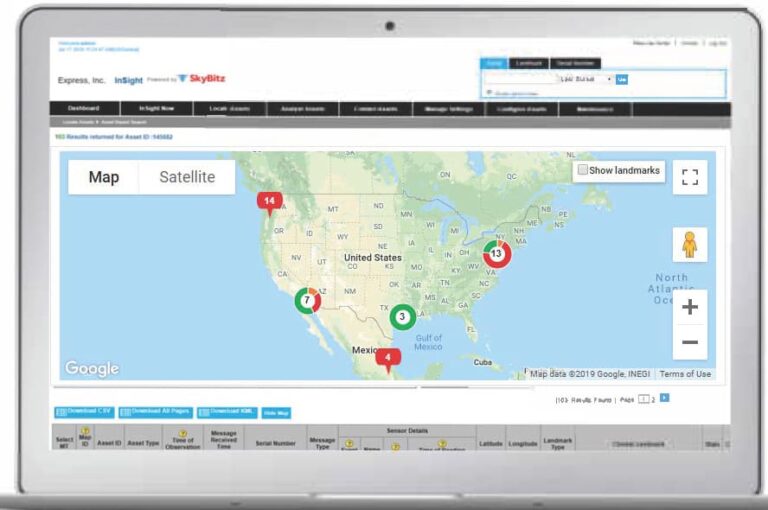

SkyBitz expands enterprise platform with enhancements, new reporting features

HERNDON, Va. — SkyBitz, a provider of IoT telematics solutions, has issued a major software upgrade to its commercial asset management platform InSight today offering a unified view of all assets. InSight is a highly configurable platform that offers a simple yet intuitive experience for tracking complex asset management environments, according to Henry Popplewell, SkyBitz president . “We are always seeking ways to demonstrate our leadership and improving our platform’s UI is certainly high on our list every time,” Popplewell said. “Our account teams are in constant communication with our customers to ensure we evolve along with the market. These improvements address certain complexities that just naturally come with enterprise-level asset management environments and we’re excited to solve these challenges through our technology.” The new features were part of an extensive customer analysis initiative where SkyBitz pooled customer data, direct feedback and user recommendations relating to navigation and style enhancements, notifications, icons and alerts, ease of use, and reporting. The secure, web-based solution is used by more than a thousand enterprises and requires no software downloads, providing SkyBitz users with immediate access to new features, a secure environment, and enhanced customer service. Popplewell said with an improved top-line navigation and hierarchy that offers instant access to a variety of data, customers can now toggle through several redesigned pages including location, analyzation and maintenance; and even fully customize a home page dashboard to skim assets or even create new settings by landmark groups, asset type, health status and dormancy filters. The longer a trailer is used and the more productive it is while in use means fewer reasons to purchase new ones. SkyBitz InSight users now have a much simpler interface when identifying profitable and non-profitable areas of the operation to pinpoint and correct under-utilized assets, customer trips, drivers and processes with the click of a button. This allows managers to easily set up and monitor KPI’s across the organization. “We ask a lot of questions and we know how to listen to our customers,” said Siamak Azmoudeh, vice president product line management and business development at SkyBitz. “By walking through parts of the system with our customers, we are constantly identifying ways in which we can improve the technology and provide solid customer support at the same time. Our software team can then be better equipped to develop technology that continues to help our clients improve their business.”

DAT Solutions: Spot truckload pricing showing signs of bottoming out

Spot truckload freight pricing held firm during the week ending August 25 despite a 3% drop in the number of posted loads, according to DAT Solutions, which operates the industry’s largest network of load boards. The number of posted trucks increased 2.6% compared to the previous week, the DAT report said. Meanwhile, pricing was virtually unchanged week over week, a sign that spot rates have hit a seasonal low prior to Labor Day, when demand typically starts to build again. National spot rate averages through August 25 were down from July averages. The spot rate for van was $1.81 per mile, 3 cents lower than the July average. Van volume on DAT’s 100 top van lanes was up 3% for the week ending August 25, but pricing changes were muted: 44 lanes were higher, 47 were lower, and nine were neutral compared to the previous week, with no dramatic swings either way. The rate from Columbus, Ohio, to Buffalo, New York, saw the biggest gain for the week. It rose 13 cents to stand at $2.82 per mile. Meanwhile, the biggest drop was for the return trip from Buffalo to Columbus; rates dropped by a dime, to $1.85 per mile. The national average van load-to-truck ratio fell from 2.4 to 2.2. The reefer rate for August 25 was $2.14 per mile, 5 cents lower than it was in July. Reefer markets have been waiting for an uplift from late summer fruit and vegetable harvests, but so far that hasn’t happened. Late-summer fruit and vegetable harvests in the Midwest and California have not made up for markets where production has struggled all year due to weather. The national average reefer load-to-truck ratio fell from 4.7 to 4.4 and rates were higher on just 24 of DAT’s 72 high-traffic lanes. Of the reefer lanes that saw higher rates, DAT reported, the biggest increases were on relatively low volumes of spot freight. Demand for trucks was heaviest in California, where the number of available loads was up 9% in Los Angeles, 8% in Fresno and 6% in Ontario. Rates in these market were softer compared to the previous week, however. DAT reported the national average flatbed rate for August 25 was $2.20 per mile, 7 cents lower than July. DAT Trendlines is a weekly snapshot of month-to-date national average rates from DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. DAT load boards average 1.2 million load searches per business day. For the latest spot market loads and rate information, visit dat.com/trendlines and follow @LoadBoards on Twitter.

Papé Kenworth opens fifth parts and service facility in Central California

TURLOCK, Calif. — To meet the growing needs of local truck fleets, owner-operators and those traveling through Central California, Papé Kenworth has opened a new 12,500 square-foot parts and service facility in Turlock. Papé Kenworth provides parts, and service support for Kenworth heavy and medium duty trucks. Papé Kenworth operates five dealerships in Central California, including Bakersfield, French Camp (Stockton), Fresno, Santa Maria, and now Turlock; eight Oregon dealerships in Donald, Eugene, Klamath Falls, Medford, Portland, Redmond, Roseburg and Tangent; and one in Kelso, Washington. In addition, Papé Kenworth Northwest operates six dealerships in Washington: Aberdeen, Bellingham, Lakewood, Marysville, SeaTac, and Yakima; and two dealerships in Alaska: Anchorage and Fairbanks. The new Papé Kenworth–Turlock, at 3200 Commerce Way, features a 5,000 square-foot service department equipped with five service bays and a 5,800 square-foot parts department that includes a 1,100 square-foot area dedicated to retail display. Located on a one-acre site, Papé Kenworth–Turlock offers ample room for drivers to maneuver and park their rigs. It also has convenient access to Highway 99. The facility includes a customer lounge to provide drivers a comfortable place to relax and catch up on paperwork while their trucks are serviced. With steady population growth in the surrounding area, the new facility will help meet the increasing needs of trucking in the area. Hours of operation are 8 a.m. to 5 p.m. Monday through Friday. The phone number is 209-252-8114. Papé Kenworth is headquartered in Eugene, Ore., and is part of The Papé Group Inc. For more information, visit www.papekenworth.com.

FTR’s Shippers Conditions Index improves again in June up two point to 8.8

BLOOMINGTON, Ind. — FTR’s Shippers Conditions Index (SCI) rose to a good positive reading in June of 8.8, up two points from the updated May measure. The June SCI reading is the strongest since February 2016. Freight-related indicators are mixed, FTR said. Manufacturing is growing very slowly, and construction is weaker. However, consumer spending remains strong. Truckload rates are about 7.5% below 2019 with spot rates down nearly 18% whereas less-than-truckload rates have been higher this year. Both are expected to decline in 2020. Intermodal rates continue to be soft with rail expecting 5% growth in 2019. “The relatively weak rate environment for truckload allows it to compete more effectively with intermodal,” said Todd Tranausky, vice president of rail and intermodal at FTR. “Intermodal volumes have been stymied by trade headwinds, changes in rail service offerings, overall rail service levels, and the weak truck market. International and domestic intermodal each struggled in June with weak results.” The Shippers Conditions Index tracks the changes representing four major conditions in the U.S. full-load freight market. These conditions are: freight demand, freight rates, fleet capacity, and fuel price. The individual metrics are combined into a single index that tracks the market conditions that influence the shippers’ freight transport environment. A positive score represents good, optimistic conditions. A negative score represents bad, pessimistic conditions. The index tells you the industry’s health at a glance. In life, running a fever is an indication of a health problem. It may not tell you exactly what’s wrong, but it alerts you to look deeper. Similarly, a reading well below zero on the FTR Trucking Conditions Index warns you of a problem…and readings high above zero spell opportunity. Readings near zero are consistent with a neutral operating environment. Double digit readings (both up or down) are warning signs for significant operating changes.