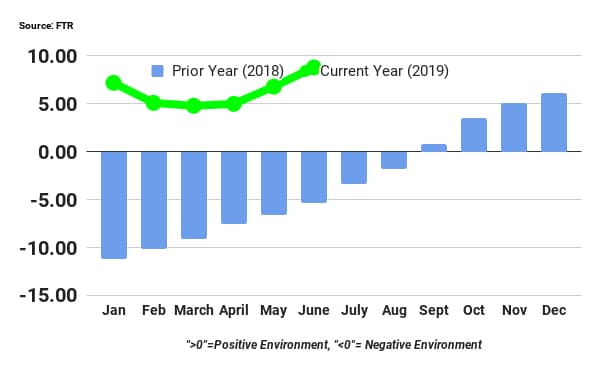

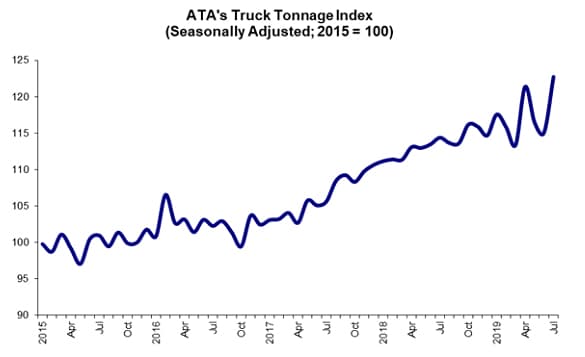

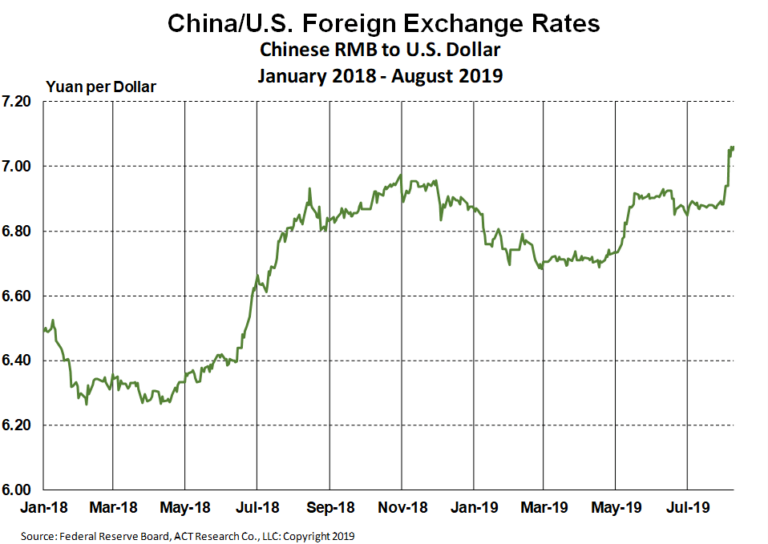

The nation’s two organizations that track and analyze data about the commercial motor vehicle market both note that trailer orders were up in July as compared to June but were still far below when compared with the same month last year. One of the two organizations reported used Class 8 sales fell for the fourth consecutive month. ACT Research said preliminary estimate for July 2019 net trailer orders is 9,900 units. Final volume will be available later this month. This preliminary market estimate should be within +/- 3% of the final order tally. FTR reported preliminary trailer orders for July at 9,000 units, up 61% from dismal June numbers but 68% below July 2018. FTR said trailer orders continue to show weakness during the summer months after experiencing a record run in the second half of last year, noting that van fleets already have their orders in for 2019 and have not started ordering yet for 2020. Although currently, production remains robust at near-record levels, some easing of build rates is expected as backlogs fall significantly to where they were at the start of 2018, FTR said. Trailer orders for the past 12 months now total 324,000 units. “While net trailer order volume improved significantly from June’s dramatically disappointing results, the industry’s year-over-year performance continued to be extremely weak. While net orders jumped 65% versus an amazingly weak June, they were 66% below this point last year, a tough comparison to the first month of the record-setting order run-up of last summer and fall,” said Frank Maly, ACT’s director of CV transportation analysis and research. “While some fleets made investment commitments in response to the opening of some 2020 order boards, their overall response was lackluster. A few months ago, there was strong interest to push commitments into next year, but uncertainty over the economy, freight volumes, and capacity has now caused many fleets to move to the sidelines as they re-assess their true needs for either replacement of older equipment or additions to fleet capacity next year.” On a positive note, Maly said the cancellation pressures of recent months appeared to ease a bit in July. However, any cancels are likely impacting fourth quarter production slots, so there is still some churn in order board occurring before year-end. “That results in a fairly soft foundation for early next year. Also worth noting is that production continued at a solid pace in July, although OEMs definitely slid back from June’s frantic pace,” he said. Don Ake, FTR vice president of commercial vehicles, said trailer orders should stay subdued in August but start to revive in September, as fleets determine their needs for next year. The environment remains uncertain, with freight growth slowing and the tariff situation in flux. “The July order volumes continue to demonstrate a possible return to normalcy in the equipment markets. The low total is representative of a typical slow summer order month, and is very close to the July 2016 number,” he said. As for the used truck market, Steve Tam, ACT’s vice president of research, said preliminary used truck sales fell 2% month-over-month, the fourth consecutive sequential drop. Other data released in ACT’s preliminary report included sequential comparisons for July 2019, which showed that average prices fell 4%, while average miles climbed 2%, and average age was up 4%. “Used truck prices are the hottest topic in the industry right now,” Tam said. “Many dealers are experiencing significant softening in prices, but the erosion is not uniform. Depending on a host of factors, experiences vary and a few factors that impact prices include customer, equipment specifications, location, and vehicle condition.” ACT’s Classes 3-8 Used Truck Report provides data on the average selling price, miles, and age based on a sample of industry data. In addition, the report provides the average selling price for top-selling Class 8 models for each of the major truck OEMs – Freightliner (Daimler); Kenworth and Peterbilt (Paccar); International (Navistar); and Volvo and Mack (Volvo).