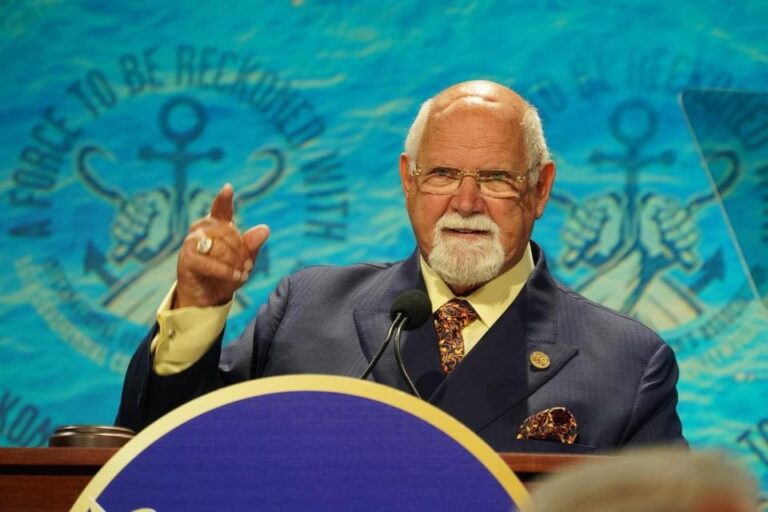

ILA Wage Scale Committee approves new USMX-ILA Master Contract agreement

HOLLYWOOD, Fla. — The full International Longshoremen’s Association Wage Scale Committee today gave unanimous approval to the new USMX-ILA Master Contract. The approval is paving the way for the ratification vote by ILA rank-and-file members that has been scheduled for February 25. “I believe our work here today moves us to the ratification vote on Tuesday, February 25, 2025, when ILA rank-and-file members will vote on what I believe is the greatest ILA contract, and the greatest contract negotiated by a labor organization,” said Harold J. Daggett, ILA president and the union’s chief negotiator. “Our collective strength helped produce the richest contact in our history.” Delegates From Across the U.S. Involved in Voting More than 200 ILA Wage Scale Committee delegates representing ILA locals from Maine to Texas were presented with details of the tentative USMX-ILA Master Contract by Harold and international executive vice president Dennis A. Daggett. The Wage Scale Committee delegates also heard from Paul DeMaria, COO and lead negotiator for United States Maritime Alliance, Ltd. (USMX). In addressing ILA Wage Scale Committee delegates, Dennis A. Daggett praised the hard work it took by many to produce the landmark agreement between USMX and the ILA and said: “Most importantly, I want to thank the ILA rank-and-file membership,” Dennis said. Terms of the Contract ILA Wage Scale Committee delegates were shown a video explaining general details of the tentative USMX-ILA Master Contract, which will be made available to all ILA locals to view prior to the February 25th ratification vote. Following the video screening, Dennis presented a detailed description of the tentative agreement that is in the form of a Memorandum of Settlement between USMX and the ILA and supplements and amends the current Master Contract. “This was the hardest and most complicated contract to bargain possibly in the history of the ILA,” Harold said after the approval of the tentative agreement. “I am proud to have previously delivered two historic contracts for (members) of the ILA, but with the changes we’ve seen across our industry we knew what this contract meant for securing our future. As we meet with the full wage scale committee, I want to make clear that this not only means more money in the pockets of our ILA members, but also a strong future for them and our entire industry.” The new agreement and all of its benefits are retroactive to October 1, 2024, and, if ratified by ILA members, will be in effect until September 30, 2030. Strength of the ILA “After the first strike in 50 years, we showed the entire world the strength of the ILA, and won a hard-fought economic agreement,” Harold said. “But even after that historic moment, I thought that it was almost certain that we would have to go out on strike again in January to get what we deserved. We’ve been able to avoid a strike for so many years because the ILA and USMX have had a strong relationship, which is the single biggest factor when it comes to reaching a deal. It isn’t good enough to just come to an agreement, we need a partner with the leadership and skills and one we trusted so that we knew we could work together and see it through.” Meeting with President Trump “It was President Donald Trump’s courageous actions in December, after meeting with Dennis Daggett and me at Mar-A-Lago, coupled with the relationship and trust we had with Paul De Maria, that made this deal possible,” Harold said. “Thank goodness USMX made Paul DeMaria the lead negotiator for management’s side when they did. Paul was uniquely qualified to move negotiations in the right direction and his appointment to this role was instrumental in avoiding a second strike. “When we were at Mar-A-Lago, it was Paul that I called and had speak directly to President Trump because I knew that he was the only person who could sit across from us at the table and get a deal done.” Tough Negotiator Harold noted that it was DeMaria’s leadership that prevented another strike. “We all knew that Paul was a tough negotiator, but he showed a lot of skill in how he worked with me, Dennis and our bargaining committee to see this through,” Harold said. “At our wage scale meetings today, I wanted to make sure that our members heard from Paul firsthand, possibly the only person who understands our industry, and knows and respects our ILA longshore workers, so that we can start to rebuild our relationship with the USMX and the shipping community. “We all have a bad taste in our mouths with how some of this played out, but we need to ratify this historic contract and then implement it. This means working with someone who will do this the right way to make sure that we don’t end up negotiating in this way again.” ILA rank-and-file members will receive details of the agreement approved by the ILA Wage Scale Committee at local meetings in the next two weeks and then participate in the ratification vote on Feb. 25. The specific details of the agreement will not be made public.