Fuel outlook: Availability and pricing should be stable through summer months

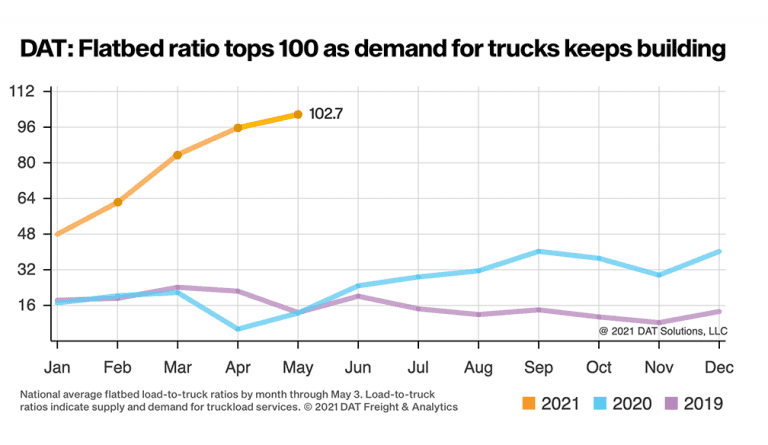

Trucks powered by electricity may be making the headlines, but trucks burning old-fashioned diesel fuel are still moving the freight. As summer approaches, diesel fuel pricing and availability are on the minds of a lot of truckers. President Joe Biden’s newly installed administration has received plenty of criticism related to increasing fuel prices, especially when it was announced he had signed an executive order halting construction of the Keystone XL Pipeline, which was slated to bring crude oil from Western Alberta, Canada, to U.S. refineries. The administration also announced its intent to stop issuing new leases for oil exploration and drilling on public lands, and to decline renewals on current leases. A look at the historical data, however, suggests that Biden’s policy isn’t to blame. According to reports from the U.S. Energy Information Administration (EIA), the national average diesel fuel price was $2.37 per gallon Nov. 2, 2020, the day before the U.S. presidential election. Each Monday for the next 20 weeks, the EIA reported that the average price had increased. Diesel prices had already risen for 11 consecutive weeks before Biden’s inauguration. More likely, diesel fuel prices were simply rebounding from the recession caused by the COVID-19 pandemic. As of the first week of May this year, the national average price of diesel was $3.14 per gallon. A year ago, in the worst of the recession, the average was $2.40. Go back another year however — to the first week of May 2019 — and the average fuel price of $3.17 was similar to today’s market. In 2018, it was $3.16 per gallon. It’s doubtful the upcoming summer will bring diesel fuel prices of $2.43 per gallon (that was the 2020 summer average). In the summer of 2019, fuel averaged $3.02. In 2018, summer prices averaged $3.23. While Biden’s policies could eventually slow future fuel production, pushing prices upward, significant increases aren’t likely in the short term. For the longer term, Biden has clearly outlined a desire to move the country away from petroleum fuels and toward newer technologies. The fuel market is not, however, without threats. In May, a Russian hacking group claimed credit for launching a ransomware attack against Colonial Pipeline, the largest mover of petroleum products in the U.S. Typical ransomware attacks entail encrypting the owner’s files so they can’t be accessed, meaning the programs that operate the pipeline can’t be run. Colonial Pipeline owners immediately shut down the line, which runs from the Gulf Coast through the Southeast and into New England, to prevent further damage. Within hours of the shutdown announcement, panic-buying was widespread, and many gas stations and truck stops were running out of fuel. Colonial’s 5,500 miles of pipeline carry about 100 million gallons of refined petroleum products per day. Replacing the pipeline’s capacity would require about 12,500 trucks pulling tank trailers, or 3,100 rail car deliveries, every day. Longer trips would require multiple days to complete, adding to the number of trucks needed. Another potential threat to fuel pricing is the shortage of available drivers. The majority of petroleum delivery positions are local, home-every-night jobs that could be popular among over-the-road drivers who want more time at home. But the negatives can add up quickly. Work schedules often include 12- to 14-hour days with few days off falling on the weekends. Many routes are subject to heavy traffic congestion in metro areas, and some venture into neighborhoods where protests have erupted into lawlessness over the past year. In addition, qualifying for the job isn’t easy. Because of the physical aspects of the job, like lifting and carrying hoses and climbing the ladder to the top of the trailer, many carriers require a physical agility test prior to hire. A hazmat endorsement is mandatory, which requires testing, completion of a background check and extra expense. Compensation, often paid per completed load, can be considerably less than drivers earned over the road, adding to the difficulty of finding and keeping drivers. Weather can also play a role in diesel availability and pricing. In February this year, a polar vortex shut down Texas and Louisiana refineries when freezing water vapor in petroleum pipelines fouled valves and filters. Fortunately, the deep freeze only lasted a few days, but it was enough to slow production and put pressure on prices. According to the National Oceanic and Atmospheric Administration (NOAA), the “official” hurricane season begins June 1 and continues through November. Last year brought a record 30 named storms, including two tropical storms that formed in May. A total of 12 made landfall in the U.S., with six of those reaching Category 3 or higher. The storms broke another record, racking up damages to the tune of nearly $65 billion. A large number of refineries are located along the Gulf Coast in Texas and Louisiana, with a few more in Mississippi and Alabama. Proximity to the Gulf makes refineries accessible to tankers bringing in crude or leaving with refined products. It also makes them vulnerable to hurricane damage. Even temporary, precautionary shutdowns could impact the fuel supply. Recent unrest in the Middle East could be another factor. If the conflict escalates to include oil-producing countries in the region, the world oil supply could be impacted. Finally, summer months are known for Americans hitting the road. After a year of COVID-19 shutdowns and sheltering at home, the highways may be crowded this year with people eager to make up for vacations they missed last year. More jet fuel will also be needed, for those who prefer flying. The increased number of travelers this summer, especially during peak travel times such as holidays, could increase demand for petroleum products and push prices higher. Truckers will do their part, too. The current economic recovery is different than those of the past. In a typical recession, manufacturers keep plants open, stockpiling products to sell when things are better. This recession brought shutdowns everywhere, with no chance to increase inventories. Depending on the product, some inventories were taken down to zero while suppliers were closed. As the economy rebounds, record shipment numbers are expected throughout the summer, keeping trucks busy — and consuming diesel fuel. Despite the threats, fuel should remain plentiful and prices stable through the summer months.