COLUMBUS, Ind. — According to ACT Research’s (ACT) latest release of the North American Commercial Vehicle OUTLOOK, the key risk to all commercial vehicle market forecasts remains the on-again trade war with China.

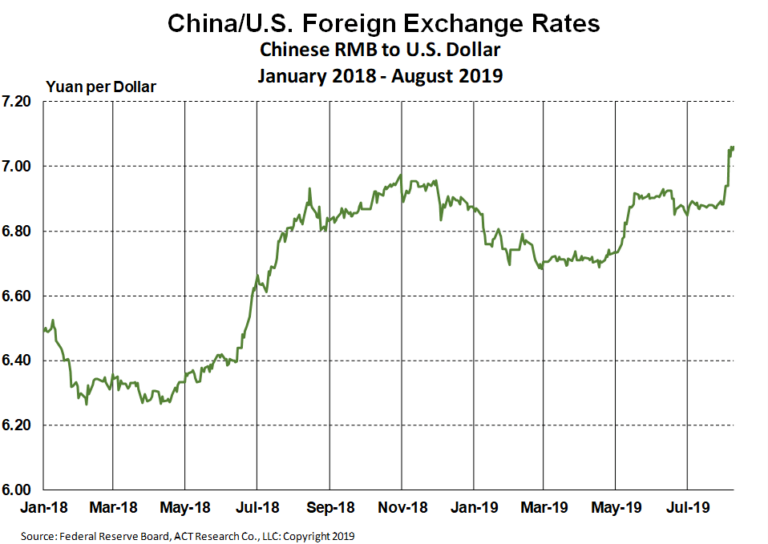

“This month’s chart, the U.S. dollar to Chinese yuan (RMB) illustrates why trade wars are neither good, nor easy to win,” said Kenny Vieth, ACT’s president and senior analyst. “As can be seen, after the U.S. fired the latest salvo in the trade war on August 1, the Chinese responded with in-kind tariffs and a 3% currency devaluation — so far. Since the first ‘shots’ of the trade war were fired on March 1, 2018, the RMB has fallen 12% versus the U.S. dollar.

“So, tariffs imposed by the U.S. have been met with in-kind tariffs from China, and the Chinese government has allowed the yuan to devalue, thereby offsetting the U.S. tariff impact, while simultaneously making US goods even more expensive in China.”

Vieth said the bigger risk, especially to emerging economies is that in order to compete with China, they will have to devalue their currencies, making US goods more expensive in more countries and raising the risk of a deeper global downturn.

ACT Research is a publisher of commercial vehicle truck, trailer, and bus industry data, market analysis and forecasting services for the North American and China markets. ACT’s analytical services are used by all major North American truck and trailer manufacturers and their suppliers, as well as banking and investment companies.

More information can be found at www.actresearch.net.

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.