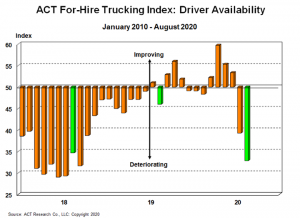

COLUMBUS, Ind. — The latest release of ACT Research’s For-Hire Trucking Index, which includes August data, showed a continuing tight trucking market, with volume and rate surges ongoing and driver availability deteriorating. August’s volume index rose to 67.9 (seasonally adjusted), and productivity was at 67.8. With capacity and driver availability in contraction territory, at 48.9 and 32.0, respectively, the combination of strong demand and tight supply pushed the pricing index up to 66.4, a new two-year high.

“The average age of U.S. truck drivers is 55, and while we usually have some number of drivers near retirement who will just participate in peak rates, the calculus is different this year,” noted Tim Denoyer, vice president and senior analyst for ACT.

“The average age of U.S. truck drivers is 55, and while we usually have some number of drivers near retirement who will just participate in peak rates, the calculus is different this year,” noted Tim Denoyer, vice president and senior analyst for ACT.

“Driver supply should improve from here, but gradually, as driver schools are still challenged by social distancing. We expect driver pay to start increasing to address the shortage, but this process takes time. Meanwhile, the acute tightness of the past few months isn’t likely to ease much,” he continued. “This month, feedback from carriers suggests that ‘mini-bids’ may shorten the lag between spot and contract rates in the coming months.”

ACT’s For-Hire Trucking Index is a monthly survey of for-hire trucking service providers. Responses are converted into diffusion indexes, where the neutral, or flat, activity level is 50. For-hire executives who are interested in participating in the survey can email [email protected] for information. Survey participants receive a detailed monthly analysis of the survey data, including volumes, freight rates, capacity, productivity and purchasing intentions, plus a complimentary copy of ACT’s Transportation Digest report.

The ACT Freight Forecast provides forecasts for the direction of truck volumes and contract rates quarterly through 2020 with three years of annual forecasts for the truckload, less-than-truckload and intermodal segments of the transportation industry. For the truckload spot market, the report provides forecasts for the next 12 months. In 2019, the average accuracy of the report’s truckload spot rate forecasts was 98%. The ACT Research Freight Forecast uses equipment capacity modeling and the firm’s economics expertise to provide unprecedented visibility for the future of freight rates, helping businesses in transportation and logistics management plan for the future with confidence.

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.

The low freight rates this summer and last fall have pushed at a lot of owners ops out of business. Unless truck drivers pay is raised to be closer to 1980 pay rates adjusted to inflation young people will take other jobs. It was a big mistake to bring in E logs without more parking at receivers and minimum wage rates for O T R truck drivers of 5000 hours experience of at least $21.00 U S per hour plus overtime after 10 hours per and to be home for 34 hour reset or a hotel room with coronavoius. The current lack of medical care for truck drivers who cross the border has resulted in some truck drivers getting medical bills of over 300,000 dollars U S because of insurance companies delayed claims.