WASHINGTON — As America has just celebrated the 100-year anniversary of the end of World War I, the American Truck Dealers (ATD) is calling on Congress to repeal the 101-year-old federal excise tax (FET) on heavy-duty trucks.

Initially imposed in 1917, the FET was meant to be a temporary measure to help pay for World War I. Although the tax was briefly repealed after the Great War ended, it was reinstituted and today is the highest percentage tax that Congress levies on a product. The FET routinely adds between $12,000-$22,000 to the cost of a new truck.

“The FET is as outdated as biplanes and trench warfare,” said Jodie Teuton, vice president of Kenworth of Louisiana and Hino of Baton Rouge. “This tax discourages deployment of today’s cleaner, safer and more fuel-efficient heavy-duty trucks.”

Two bills, H.R. 2946 and S. 3052, have been introduced which would repeal the antiquated FET. ATD and a coalition of trucking industry stakeholders are urging Congress to revisit this tax and consider the FET repeal as part of a likely infrastructure bill coming next year.

Sen. Cory Gardner, R-Colo., introduced S 3052, which is similar to the “Heavy Truck, Tractor and Trailer Retail Federal Excise Tax Repeal Act” introduced by Rep. Doug LaMalfa, R-Calif., in June 2017.

Gardner’s bill was referred to the Senate Finance Committee. LaMalfa’s bill was referred to the House Ways and Means Committee.

There has been no committee action on either of the bills.

Both Gardner and LaMalfa will be members of the new Congress that begins in January 2019 and would have to reintroduce their bills if no action is taken by the end of the current Congress.

“This burdensome tax creates excessive costs that are passed on to truckers, who play an essential role in maintaining our nation’s economy,” Gardner said. “I was happy to introduce legislation to repeal it.”

“The FET is not simply a barrier to selling more vehicles – it is a barrier to the public being able to drive alongside the cleanest, safest and most technologically advanced trucks built today,” said Jake Jacoby, president and CEO of the Truck Renting and Leasing Association. “To have a tax that literally discourages businesses from purchasing the newest available equipment hurts all involved – from the manufacturer, to the dealer, to the purchaser and ultimately the end user.”

Mike Kastner, managing director of NTEA-The Association for the Work Truck Industry, said, “The 12-percent federal excise tax on trucks and truck equipment primarily manufactured in the U.S. is antiquated, overly complex, and counterproductive to safety and environmental concerns. We advocate that this tax be repealed for the betterment of the work truck industry and the economy at large.”

“Now is the time to repeal the FET and replace it with a 21st century policy and revenue structure that meets the needs of our economy,” Teuton said.

ATD, a division of the National Automobile Dealers Association, represents more than 1,800 medium- and heavy-duty truck dealerships in the U.S.

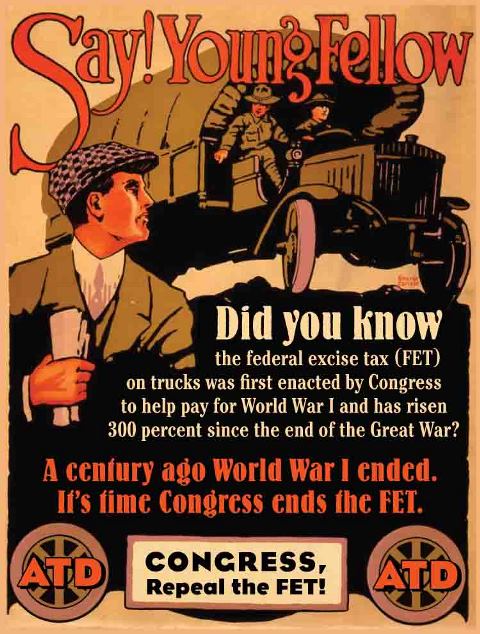

CAPTION FOR PHOTO

The American Truck Dealers are using World War I era posters to encourage Congress to end the federal excise tax on heavy-duty trucks. (Courtesy: AMERICAN TRUCK DEALERS)

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.