COLUMBUS, Ind. — Cummins’ first quarter 2024 revenue hit $8.4 billion, with a net income of $2.0 billion, according to a financial report. This represents all company sectors.

A number of company components factored into the financials that reflected strong demand, according to Jennifer Rumsey, Chair and CEO.

“We delivered solid profitability and also completed the separation of Atmus (a filtration technology company), allowing Cummins to continue its focus on advancing innovative power solutions and positioning Atmus to pursue its own plans for profitable growth,” Rumsey said. “I am deeply appreciative of our Cummins employees across the globe, whose broad expertise and diverse perspectives are driving our ability to innovate for our customers and meet global demand.”

Cummins’ earnings before interest, taxes, depreciation and amortization (EBITDA) was 30.6% of sales, representing an increase year-over-year of 14.5%

Cummins separation with Atmus resulted in $1.3 million in revenue. As a result of the separation, the company is raising its expectations for full year 2024 revenue. First quarter revenues decreased 1% year over year, as did international revenues due to lower demand in China and Europe.

“We have raised our expectations on revenue and profitability for 2024 due to continued demand for Cummins’ products and services. We do still expect slowing demand in some of our key markets in the second half of the year,” said Rumsey. “Despite lower sales, Cummins is in a strong position to keep investing in future growth, bringing new technologies to customers and returning cash to shareholders.”

Based on the current forecast, Cummins projects full year 2024 revenues to decline year over year by 2%-5%. EBITDA guidance reflects an increase over the prior guidance of 14.4% and 15.4%.

In its distribution segment, sales were up 5% to $2.5 billion.

EBITDA for the segment was $294 million or 11.6% of sales. Revenues in North America and internationally increased 2% and 14%, respectively, with higher revenues driven by increased demand for power generation products and pricing actions.

“Cummins plans to continue to generate strong operating cash flow and returns for shareholders and is committed to our long-term strategic goal of returning 50% of operating cash flow back to shareholders,” said Rumsey. “In the near term, we will focus on reinvesting for profitable growth, dividends and reducing debt.”

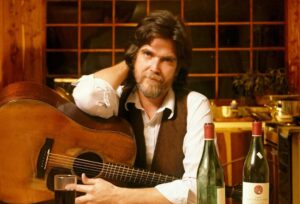

Since retiring from a career as an outdoor recreation professional from the State of Arkansas, Kris Rutherford has worked as a freelance writer and, with his wife, owns and publishes a small Northeast Texas newspaper, The Roxton Progress. Kris has worked as a ghostwriter and editor and has authored seven books of his own. He became interested in the trucking industry as a child in the 1970s when his family traveled the interstates twice a year between their home in Maine and their native Texas. He has been a classic country music enthusiast since the age of nine when he developed a special interest in trucking songs.