BATON ROUGE, La. — The latest bid to boost Louisiana’s gasoline tax has ended without a legislative vote.

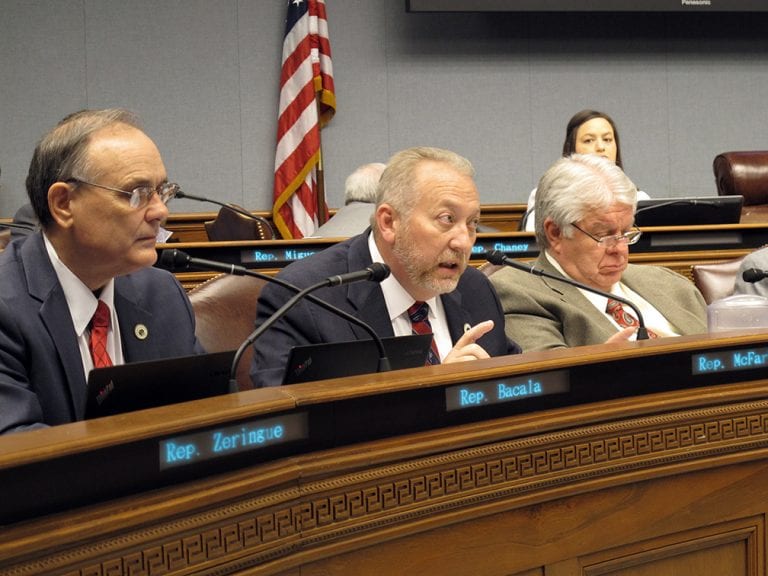

Rep. Jack McFarland said Thursday, March 25, he’s shelving the tax hike proposal ahead of the legislative session that starts April 12, as billions of dollars in federal coronavirus aid that could be used for road and bridge work is headed to Louisiana.

The Winnfield, Louisiana, Republican, who spent months traveling the state to pitch the gas tax proposal to organizations and colleagues, said he’ll continue pushing legislation to rework financing for the transportation department, steer more money to projects and add more oversight of spending.

“I’m restructuring my bill. I’m going to take the revenue-raising measure out of it,” McFarland said.

The north Louisiana lawmaker faced significant opposition from within his own party for his phased-in, 22-cent tax hike, which eventually would have raised an extra $600 million-plus yearly by 2033. Both Democratic Gov. John Bel Edwards and Republican Senate President Page Cortez said March 24 that they didn’t see enough support to raise the gas tax this year.

Supporters of an increase point to Louisiana’s $15 billion backlog of road and bridge work and its list of $13 billion in projects to improve traffic flow and lessen gridlock. But critics, including the chairman of the state GOP, slammed the tax hike as unaffordable, particularly in a pandemic.

It would have taken a two-thirds vote to pass, a hurdle that has stalled previous gas tax hikes sponsored by other lawmakers in 2017 and 2019.

McFarland’s tax hike proposal was further undermined by an influx of federal coronavirus aid pushed by President Joe Biden and passed by Democrats in Congress earlier in March.

Louisiana state government expects to receive more than $3 billion from the federal package, and local government agencies are slated to get $1.8 billion. Those dollars could be steered to roads, bridges and other infrastructure projects.

“It is extremely hard to make the pitch to legislators and even the public when they see this much money coming to the state from the federal government,” McFarland said.

The lawmaker’s decision to scrap the gas tax hike was first reported March 25 by political reporter Jeremy Alford.

Motorists in Louisiana pay 38.4 cents in taxes per gallon of gasoline, including 20 cents in state taxes. The state rate hasn’t changed since 1990. Louisiana ranks 43rd in the nation for what it charges drivers to fuel vehicles, according to The Tax Foundation.

McFarland had proposed to raise the state tax 22 cents by 2033, starting with a 10-cent per gallon increase in 2021, then 2 additional cents every other year for the next 12 years. The hike was estimated to raise $300 million annually in the first year and grow to $660 million yearly by 2033. New fees also would have been charged on electric and hybrid vehicles.

Rather than the tax increase, McFarland said he’ll propose moving all the current gas tax revenue to projects and prohibiting it from being spent on transportation department administration — a shift that would require lawmakers to find other dollars to pay for agency operations. He’ll propose fee increases for the department to help cover some of those administrative costs and seek to earmark all vehicle sales taxes to the agency, stripping the dollars from other state spending areas.

By Melinda Deslatte, The Associated Press

The Associated Press is an independent global news organization dedicated to factual reporting. Founded in 1846, AP today remains the most trusted source of fast, accurate, unbiased news in all formats and the essential provider of the technology and services vital to the news business. The Trucker Media Group is subscriber of The Associated Press has been granted the license to use this content on TheTrucker.com and The Trucker newspaper in accordance with its Content License Agreement with The Associated Press.

McFarland is right on point. He is looking at the big picture “the long run” l support this theory 100 percent